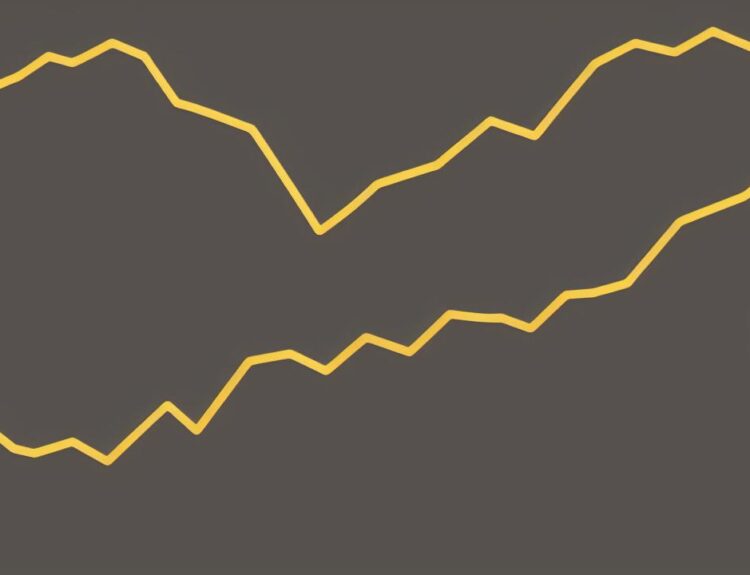

Between Feb. 25 and March 7, Worldcoin (WLD) prices experienced a 40% dip from its all-time high of $9.50 following a lawsuit filed by Elon Musk against Worldcoin’s parent company.

Bullish and Bearish Trends

Worldcoin price movements have been influenced by both bullish tailwinds, such as the NVIDIA-led Crypto AI renaissance, and bearish headlines, including the legal battle between Elon Musk and OpenAI, since March 1.

On-Chain Data Insights

On-chain data trends offer valuable insights into the initial response among crypto whales and long-term investors in Worldcoin, which could impact short-term price action of WLD.

Worldcoin price initially dipped 40% after Elon Musk filed lawsuit

Elon Musk’s lawsuit against OpenAI on March 1 led to a 40% drop in Worldcoin’s price, erasing gains from a historic rally that saw WLD hit an all-time high of $9.50 on Feb 25.

Whale and Long-Term Investor Behavior

Crypto whales have continued to invest in Worldcoin despite the legal turmoil, acquiring 720,000 WLD tokens between March 2 and March 7. This indicates confidence in potential future gains as the project evolves.

Long-term investors in Worldcoin have refrained from selling their tokens, as shown by declining WLD Age Consumed metrics since the lawsuit was filed. This suggests strong conviction in the project’s fundamentals.

Price Outlook

Early bullish reactions from whales and long-term investors may support WLD prices in the near term, potentially leading to a rebound from the recent low of $5.60 to $7.20. This bullish sentiment could drive Worldcoin towards $10 if current dynamics persist amid the legal battle.

For more updates and news on Worldcoin and other cryptocurrencies, explore Global Crypto News.