Toncoin Price Drops to Key Support Level Amid Rising Inflation and Exchange Balances

The price of Toncoin has fallen to a crucial support level, with exchange balances and inflation on the rise, while its burn rate continues to decline. As of the latest data, Toncoin’s price has dropped to $4.80, marking its lowest level since November 6 last year. This represents a 33% decline from its highest level in November.

Exchange Inflows and Burn Rate Decline

Third-party data indicates that the price drop coincided with increased exchange inflows, suggesting that investors are continuing to sell their Toncoin holdings. Over the past seven days, more than 240,000 Toncoin coins were moved to exchanges. This surge in exchange inflows is typically a bearish signal, indicating a lack of confidence in the cryptocurrency.

Furthermore, data from Ton Stat shows that the daily burn rate of Toncoin is decreasing. On January 28, only 5,805 coins, valued at $27,000, were burned, which is down from this month’s high of 15,000. A declining burn rate is usually a bearish signal, as it suggests fewer coins are being removed from circulation each day.

Rising Inflation and Pressure on the TON Blockchain Ecosystem

The number of newly minted Toncoin coins is increasing, pushing the annual inflation rate to its highest level in almost six months. The inflation rate rose to 0.37%, up from last year’s low of 0.337%. This increase in inflation can lead to a decrease in the value of each individual coin, making it less attractive to investors.

The TON blockchain ecosystem is also under pressure, with many popular tokens, including Notcoin and Hamster Kombat, hovering near their all-time lows. This decline in the value of tokens within the ecosystem can have a ripple effect, impacting the overall value of Toncoin.

Technical Analysis: Bearish Patterns and Downward Trend

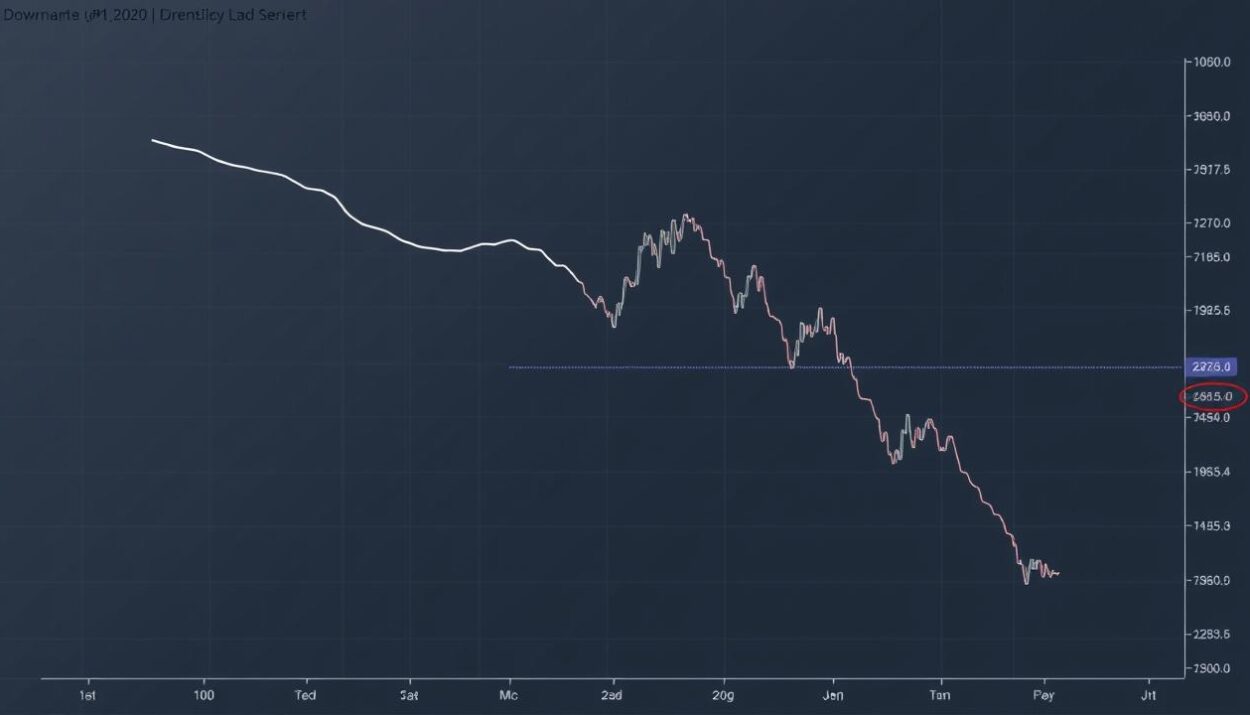

A review of the daily chart shows that Toncoin’s price fell to $4.70, extending a downtrend that began after reaching a high of $8.30 in June last year. This decline aligns with the lower boundary of a symmetrical triangle pattern, which can be a bearish signal.

Toncoin has also formed a death cross pattern, where the 50-day and 200-day Exponential Moving Averages have crossed. Historically, this pattern is considered one of the most bearish in the market. Oscillators like the Relative Strength Index and the Money Flow Index are also trending downward, indicating a potential further decline in the price of Toncoin.

As a result, Toncoin’s price risks dropping further to the 61.8% Fibonacci retracement level at $3.78, which is approximately 22% below its current level. Investors should exercise caution and consider the technical analysis and market trends before making any investment decisions.

Stay up-to-date with the latest news and trends in the cryptocurrency market on Global Crypto News.