A meme coin fund launched by Three Arrows Capital has come under scrutiny for allocating around 84% of its tokens to wallets belonging to team members and insiders.

Token Allocation Concerns

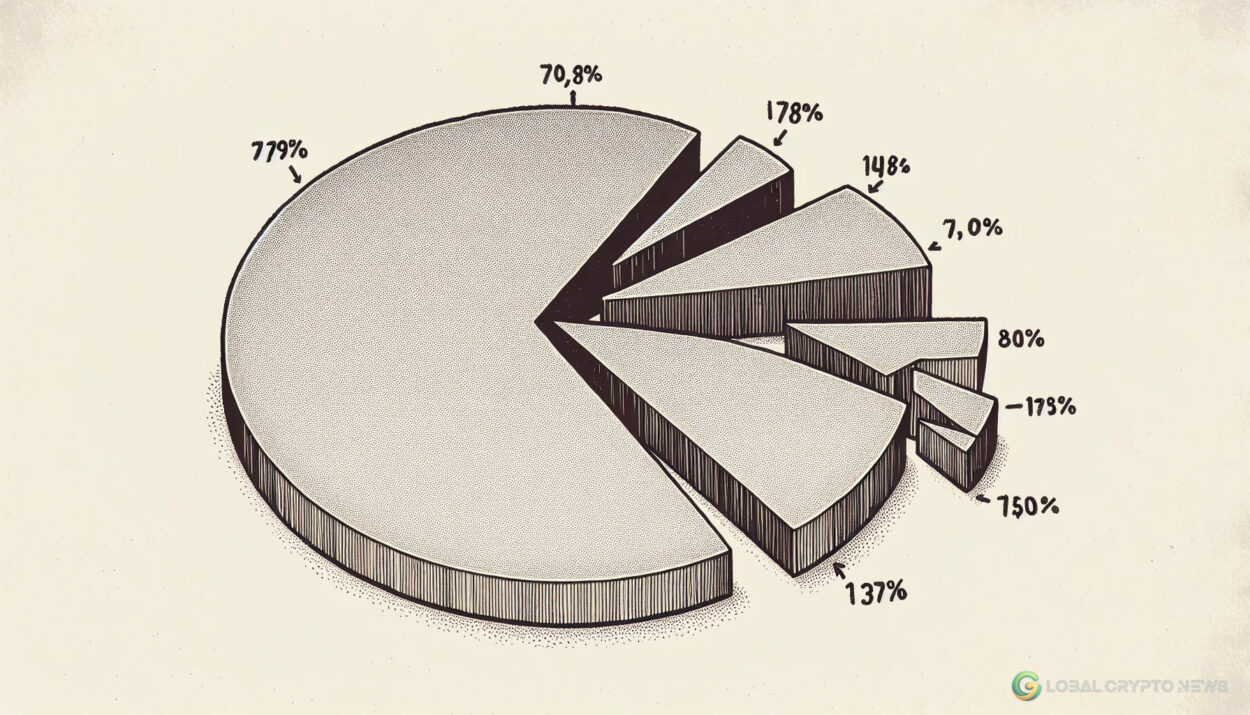

Blockchain analytics from BubbleMaps revealed that more than 80% of Three Arrows Capital’s meme coin fund, Three Arrowz Capitel, appeared to be concentrated in a few wallets owned by insiders and team members. This has led to investor speculation about potential price inflation and manipulation tactics.

Investor Insights

An investment partner from L1D elaborated on this issue in an article. According to on-chain data, the team collected 750 Ethereum tokens from approximately 25 investors during a private pre-sale. During the official launch, the remaining 336 ETH were distributed across eight wallets belonging to the team, who secured $3AC listings early. These wallets are expected to benefit between ten to thirty times their initial investment.

“It should be clear that buying into this token means placing your trust in a small group of insiders who control over 84% of the supply. Some might even label it a cabal token. The choice is yours: decide if you want to play that game.”

Token Distribution

Further analysis showed that only 8% of the tokens are allocated to the community, with another 8% designated for liquidity. The remaining 84% are held by insider wallets. This raises concerns about the potential for market manipulation due to the low circulating supply controlled by a small group of insiders.

On September 27, Three Arrows Capital launched a token with the ticker 3AC. The meme coin is part of the investment fund’s initiative to target high-risk projects, featuring a whimsical website with playful references to various meme coins, including “dog” and “cat” tokens alongside the 3AC logo.

Market Performance

Within the first few hours of trading, the market capitalization of 3AC soared to nearly $100 million, briefly peaking at over $170 million.

Background on Three Arrows Capital

Three Arrows Capital filed for bankruptcy in July 2022 after failing to meet creditors’ demands during a massive market downturn. In 2021, the firm managed $10 billion in assets before its collapse. By April 2022, this amount had dropped to $3 billion and continued to decline until bankruptcy was declared.

On September 14, the Monetary Authority of Singapore issued a nine-year prohibition order against the 3AC founders, Zhu Su and Kyle Livingston Davies, for violating various securities laws. Despite these setbacks, Zhu and Davies have pursued other crypto-related projects, including the OPNX cryptocurrency exchange, which also shut down within a year.

Stay updated on the latest cryptocurrency news and trends.

#StableCoin #CryptoAssets