Solana and XRP Experience Nearly Double-Digit Declines Amid Market Volatility

Recent market corrections have led to significant declines in the prices of Solana (SOL) and XRP, with both cryptocurrencies experiencing nearly double-digit drops in the past week. The decline in Bitcoin (BTC) prices has dragged down most altcoins, with traders assessing developments in artificial intelligence and the ETF hype surrounding Solana and XRP.

Solana Ecosystem Metrics and Growth

On-chain metrics tracking the activity, participation, and relevance of the Solana blockchain among traders show a decline across all three factors. The 7-day moving average of active addresses on the network is trending downward, signaling declining user engagement and potentially negatively impacting fees collected and overall protocol revenue.

In addition to a decline in active addresses, the number of new addresses on Solana is also decreasing, indicating reduced participation from traders. Combined with a drop in the total value of assets locked (TVL), this highlights Solana’s struggle to maintain relevance and compete with other blockchains.

According to DeFiLlama data, Solana’s TVL has dropped nearly 16% from its January 20 peak of $12.1 billion to $10.227 billion. While TVL remains above the average level observed in 2024, the decline is a concerning sign for the Solana ecosystem.

XRP Ecosystem Updates, Lawsuit, and Trump Effect

XRP price fell 16% over the past week, largely attributed to a broader market correction. President Trump’s announcement of new tariffs on Canada, Mexico, and China has fueled fears of rising inflation, and the U.S. Federal Reserve remains hesitant to cut interest rates in 2025.

Ripple’s Chief Technology Officer (CTO) Stuart Alderoty expressed confidence in the new administration under Trump and expects a resolution to the U.S. Securities and Exchange Commission’s (SEC) lawsuit against Ripple. With Trump’s new crypto task force lead SEC’s Hester Peirce, Alderoty believes positive regulation could help resolve the conflict between the U.S. financial regulator and the cross-border payment firm Ripple.

Solana and XRP Derivatives and On-Chain Analysis

Derivatives data from Coinglass shows that over $332 million in crypto derivatives were liquidated in the past 24 hours. More than $11 million in Solana derivatives positions were wiped out, with bullish bets suffering the most compared to bearish positions.

XRP also saw a significant increase in options volume and open interest, reflecting the net value of all outstanding derivatives contracts. According to Coinglass data, over $14 million in derivatives positions were liquidated amid the market-wide correction.

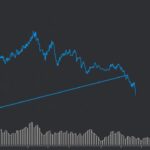

SOL and XRP Technical Analysis and Price Targets

Solana maintains its long-term upward trend even as SOL consolidates near key support above the $200 level. SOL could find support in the two imbalance zones between $190.11 and $198.47 and $169.39 to $185.84.

XRP is consolidating close to support at $2.3699, a key level for the altcoin. XRP could find support in the FVG between $2.3699 and $2.4700. Technical indicators on the daily timeframe show similar bearish outlook as for Solana.

Expert Commentary on Solana Meme Coins and XRP, Solana ETFs

Tim Ogilvie, Global Head of Institutional at Kraken exchange, shared his thoughts on meme coins and the Solana meme coin ecosystem:

“Meme coins transform cultural moments into tradable assets, allowing investors to engage and capitalize on trending narratives. Solana has emerged as the epicenter of the meme coin ecosystem, thanks to its high throughput and low transaction costs. While the long-term trajectory remains uncertain, meme coins have the potential to significantly expand crypto adoption by tapping into contemporary zeitgeist.”

“We’re seeing a number of active spot ETF filings for assets like Dogecoin (DOGE), Solana (SOL), XRP, and Litecoin (LTC) from major players like Bitwise and Grayscale. If the SEC approves these, it will signal greater legitimacy for the digital asset industry and trigger more capital inflows, potentially driving prices upward.”

To stay up-to-date with the latest news and trends in the cryptocurrency space, visit Global Crypto News for more insights and expert analysis.