Bitcoin Price Faces Risks Amid Rising U.S. Treasury Yields

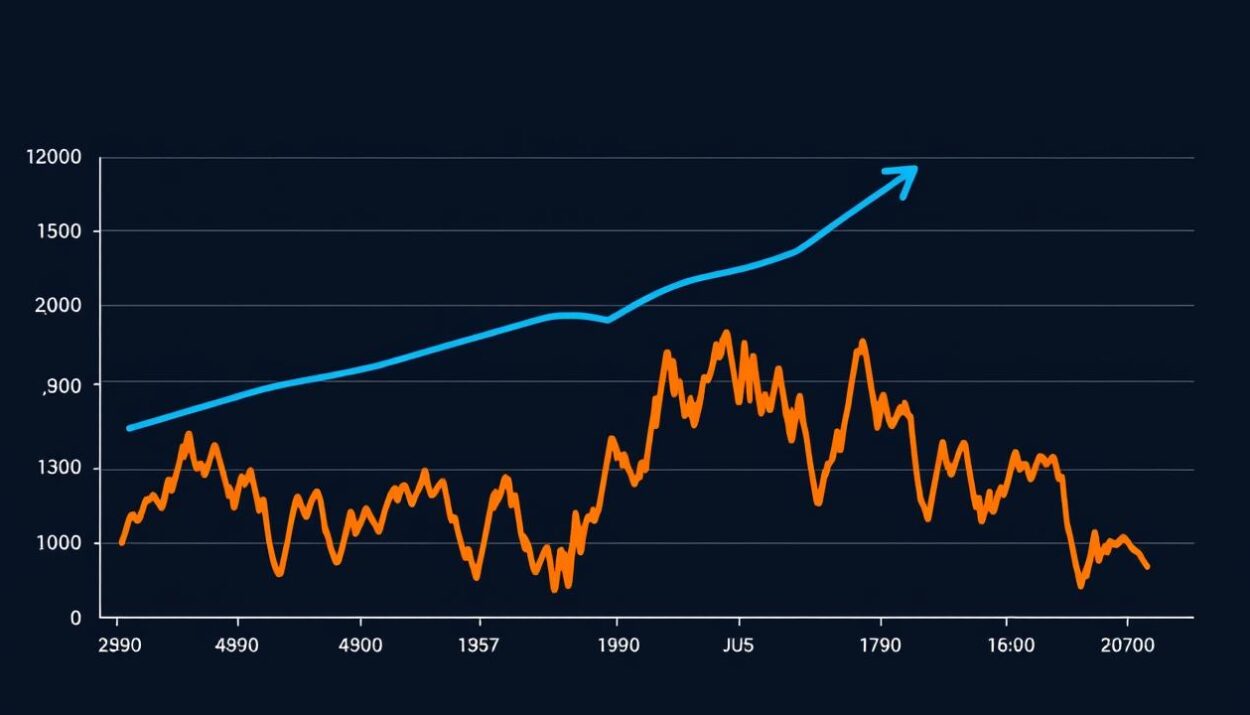

Despite its recent strong rally, the Bitcoin price faces a significant risk due to the increasing U.S. Treasury yields. The cryptocurrency has surged from its 2022 lows to a record high of $108,000 in December, driven by multiple tailwinds such as rising ETF inflows, which have exceeded $35 billion.

Increasing Treasury Yields: A Threat to Bitcoin Price

Following the Federal Reserve’s recent decision to cut rates by 0.25%, U.S. Treasury yields have risen to their highest levels in months. This increase in yields poses a significant threat to the Bitcoin price and stocks, as higher bond yields negatively impact risky assets. As investors shift toward safer assets, money market fund assets have risen to $6.83 trillion, up from $5 trillion in 2020.

I’ve argued that most asset markets appear overvalued, bordering on frothy. Stocks, corporate bonds, single family housing, crypto and gold, quickly come to mind. But what could be the catalyst for them to selloff? How about a meaningful correction in the Treasury bond market.

Short-Term Tailwinds for Bitcoin Price

Despite the risks posed by rising U.S. Treasury yields, the Bitcoin price has several short-term tailwinds that could push it to its all-time high. These include:

- The January Effect, where investors buy back assets after the Christmas holiday.

- The upcoming $16 billion FTX distributions.

- The change of guard at the Securities and Exchange Commission.

Technical Analysis: Bitcoin Price Support

From a technical perspective, the Bitcoin price appears to have found substantial support, consistently holding above its ascending trendline. It has also remained above the 50-day moving average, while the MVRV indicator continues to trend upward. These indicators suggest that the Bitcoin price is likely to rise during the first quarter, although it could stall or pull back in Q2.

Stay up-to-date with the latest cryptocurrency news and trends on Global Crypto News. Follow us for more insights and analysis on the Bitcoin price and the broader cryptocurrency market.