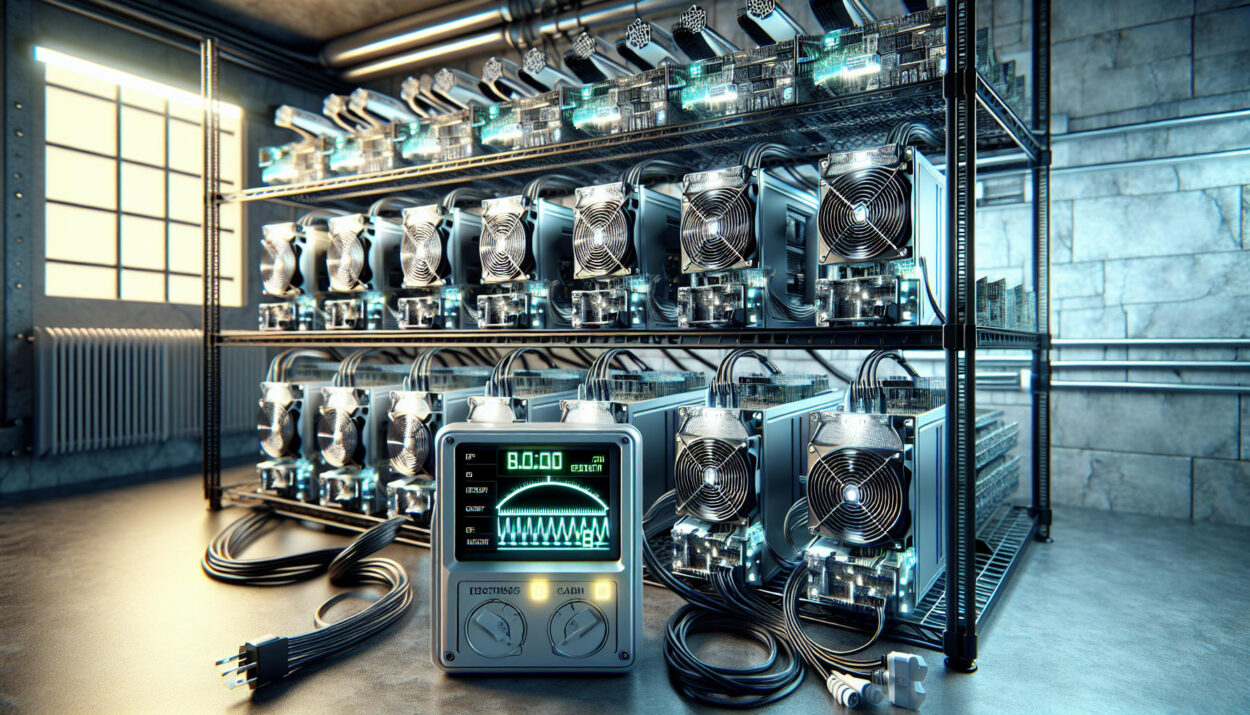

President Joe Biden has included a proposal in his upcoming budget to impose a 30% tax on the electricity consumption of cryptocurrency mining operations. This proposal is part of the “Fiscal Year 2025 Revenue Proposals” and aims to expand the tax base to include digital assets, which are currently not fully covered under existing guidelines.

Key Points:

- The tax will be phased in, starting at 10% in the first year, increasing to 20% in the second year, and settling at 30% from the third year onwards.

- Crypto mining companies will need to document their electricity consumption, with a focus on the value of electricity purchased from external sources.

- The proposal has sparked debate within the crypto community, with concerns raised about its impact on the industry’s development in the United States.

Biden administration is proposing a 30% tax on electricity used by #bitcoin miners, even if you are off-grid using your own solar and wind generation. All of the reasons they provide are pretextual, their real reason is that they want to suppress Bitcoin and launch a CBDC.

Senator Cynthia Lummis has publicly opposed the tax, highlighting the potential negative consequences it could have on the cryptocurrency industry in the United States. The proposal is part of President Biden’s broader agenda to regulate and generate revenue from the digital asset market, including measures to enforce wash trading rules and enhance reporting requirements.

Final Thoughts:

Despite the potential for revenue generation, the proposal faces opposition from Congressional Republicans who criticize the focus on increased spending. The budget proposal and discussions surrounding it intersect with recent political events, reflecting fiscal policy considerations and the evolving regulatory landscape for digital currencies.

For more news and updates on cryptocurrency regulations and developments, continue exploring Global Crypto News.