Memecoin Market Sees 5% Boost Amid LIBRA Scandal Investigation

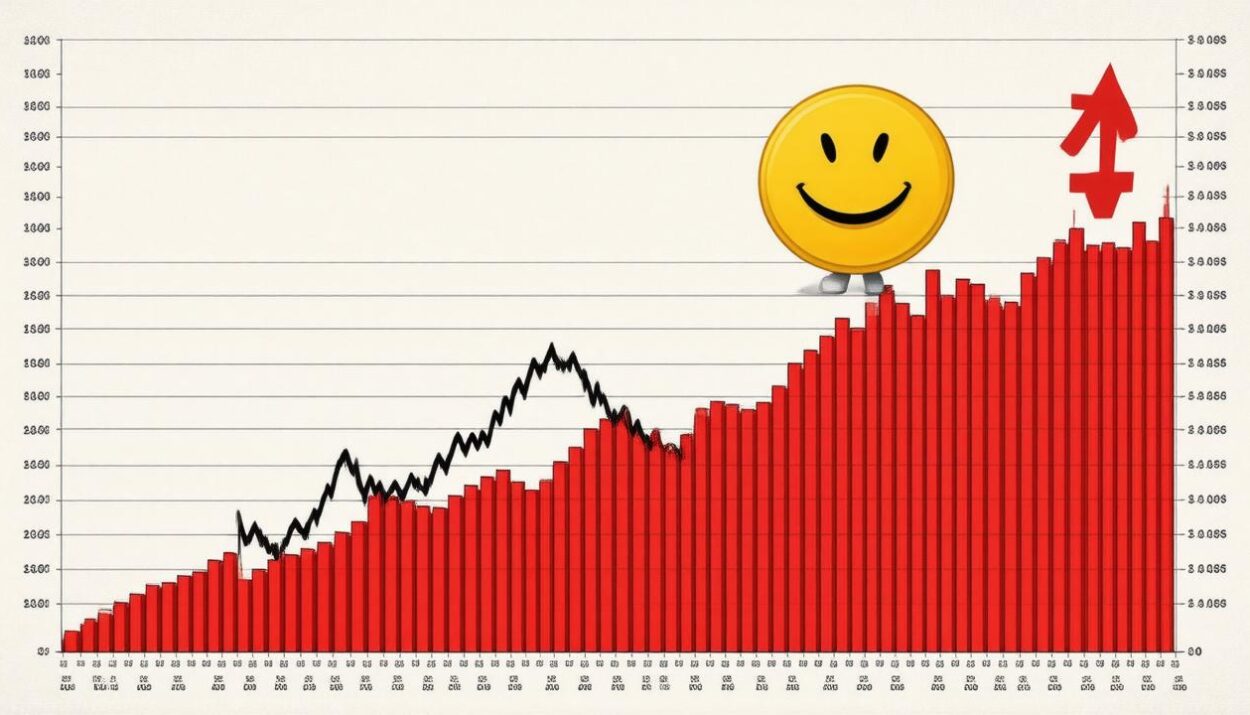

The memecoin market has experienced a notable surge, with its overall market capitalization increasing by 5% in the past 24 hours. This upward trend comes amidst an ongoing investigation into the LIBRA meme coin scandal, which has been making headlines in recent weeks.

Market Performance and Key Players

As of March 6, the overall market capitalization for memecoins nearly reached $62 million. Among the top traded tokens, FARTCOIN saw a significant rise of nearly 27% to a price of $0.35, while the official Trump coin increased by 2.3% to $13.70.

Despite the recent slump in the memecoin market, triggered by a series of “presidential meme coin” drops, including the official TRUMP meme coin and the LIBRA meme coin endorsed by Argentinian President Javier Milei, the market appears to be recovering slowly.

The LIBRA Meme Coin Scandal and Ongoing Investigation

The LIBRA meme coin scandal, dubbed “Libragate” by traders, has led to widespread criticism and calls for President Milei’s impeachment. The scandal began when Milei promoted a token on his social media account, claiming it would boost the Argentine economy by funding small projects.

However, the memecoin crashed shortly after its launch, wiping out $4.4 billion in market capitalization and affecting the overall memecoin market. According to a recent report, around 86% of LIBRA traders suffered losses amounting to $251 million between February 14 and 18.

Argentine federal prosecutor Eduardo Taiano has announced plans to freeze around $110 million in assets as part of the ongoing investigation into President Milei’s involvement in the collapse of the LIBRA meme coin. The prosecutor has also requested access to the president’s deleted social media posts, which allegedly promoted the Solana-based memecoin.

“The investigation is ongoing, and authorities are working to freeze funds in digital wallets linked to the meme coin scandal.”

Possible Money Laundering Efforts

On-chain data shows that at least eight wallets linked to the LIBRA team made a profit of $107 million before the token’s downfall. Recently, funds amounting to $4.5 million were moved from one of the wallets to a new digital address, which was later used to purchase the POPE meme coin, sparking concerns about possible money laundering efforts.

Tips for Memecoin Investors

When investing in memecoins, it’s essential to:

- Conduct thorough research on the coin and its team

- Stay up-to-date with market trends and news

- Diversify your portfolio to minimize risk

- Be cautious of potential scams and unverified sources

Stay informed about the latest developments in the world of cryptocurrencies and memecoins with Global Crypto News. For more news and updates, visit our website and explore our collection of articles and insights.