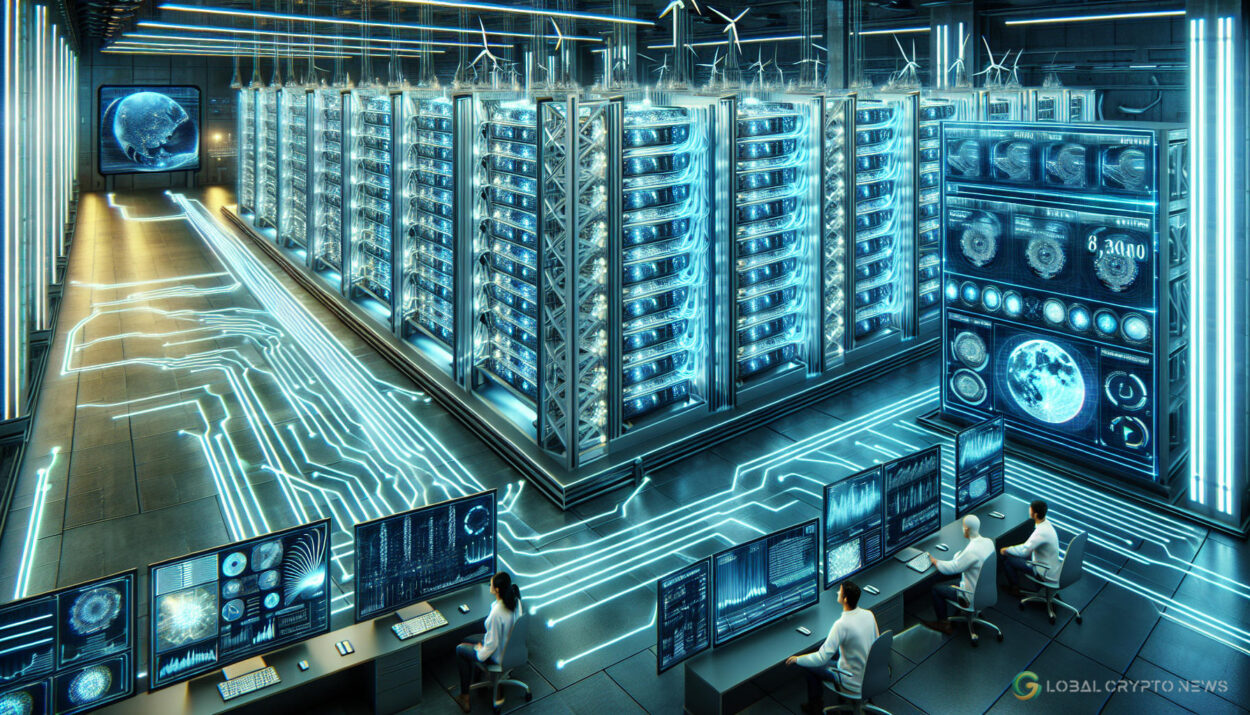

Marathon Digital recently announced an upward revision of its 2024 hash rate goal to 50 EH/s, up from the initial target of 35-37 EH/s. This decision follows recent acquisitions that have expanded the company’s mining capacity.

Marathon’s CEO, Fred Thiel, mentioned in a press release that the firm could potentially double its mining scale by 2024 due to the added capacity. The new target of 50 EH/s is said to be fully funded, eliminating the need for additional capital.

The company acquired a 200-megawatt Bitcoin mining facility from Digital Applied for $87.3 million in March, and two additional sites with a combined capacity of 390 megawatts were acquired from Generate Capital for $179 million in December.

Currently, Marathon’s operations achieve a hash rate of 24.7 EH/s, placing it ahead of competitors like Core Scientific and Riot Platforms. If Marathon reaches its 50 EH/s target, it will have increased its hash rate by over 100% since the beginning of 2024.

Marathon’s stock price saw a slight decline on April 25 but rallied in after-hours trade following the announcement of the hash rate target increase. The stock price closed at $19.01 on April 25 before experiencing a 3.05% increase in after-hours trading.

Since the fourth Bitcoin halving event at block 840,000 on April 20, Marathon’s stock has climbed by more than 15%. This trend is also observed in other mining companies within the sector.

Despite the surge in demand driven by memecoin and nonfungible token enthusiasts, transaction fees dropped to $28.20 by April 24. As the crypto mining sector continues to grow, companies like Riot Platforms are also experiencing significant market movements.

Analysts have provided optimistic evaluations for Riot Platforms, with shares surging by more than 20% on April 23. This growth is fueled by expectations of substantial financial performance improvements in the company.

Overall, Marathon Digital’s revision of its hash rate goal and the subsequent market movements indicate a positive outlook for the company and the cryptocurrency mining sector as a whole.