Ethereum Sees Rapid Price Rebound Following Tariff News and High-Profile Endorsement

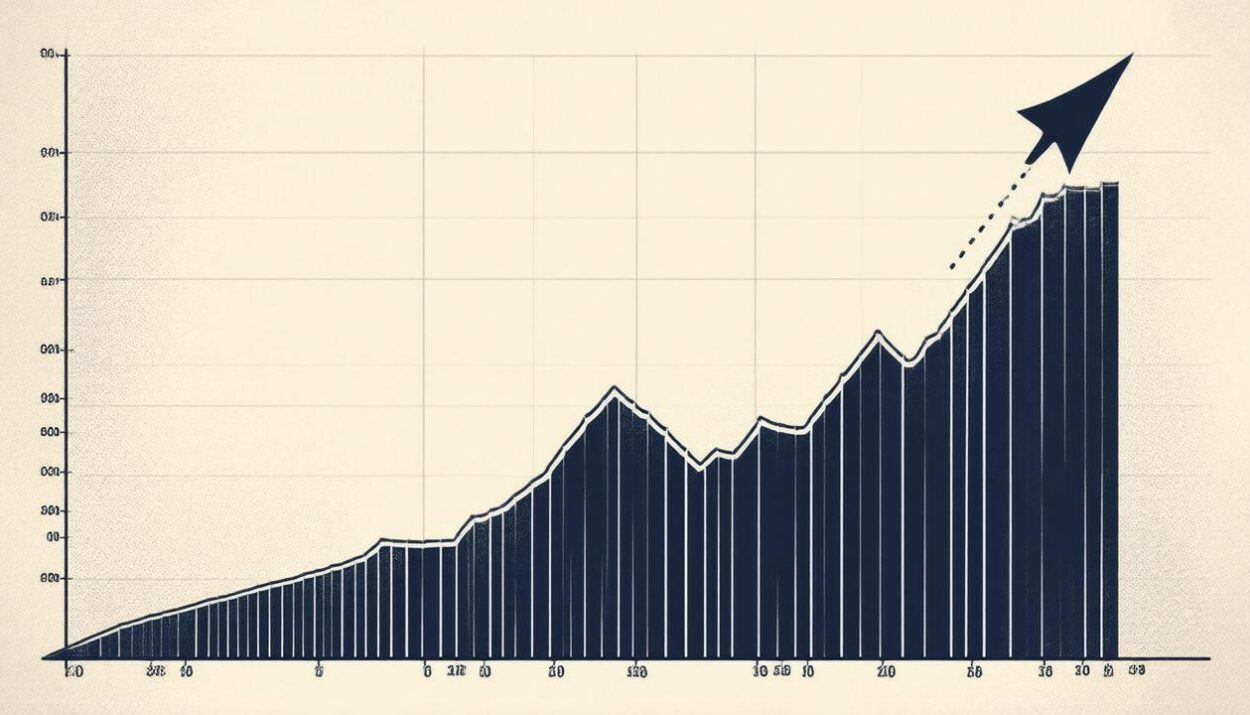

Ethereum’s price experienced a significant surge, jumping from approximately $2,300 to over $2,900 in less than 24 hours. This rapid recovery followed a post-tariff crypto market downturn on February 3, which saw the Ethereum price plummet to a low of around $2,300.

The rebound was fueled by a bullish endorsement from Eric Trump, who expressed his positive sentiment towards Ethereum in a recent post. However, Ethereum had already started rebounding to around $2,700 after U.S. President Donald Trump announced a temporary halt on proposed trade tariffs on Canada and Mexico. Eric Trump’s post served as a catalyst, fueling the second half of the rally.

In my opinion, it’s a great time to add $ETH.

The Trump family has a vested interest in Ethereum through World Liberty Financial, a new DeFi project backed by President Donald Trump. Notably, the project’s recent actions may have contributed to the Ethereum price surge. World Liberty Financial suddenly and nearly totally liquidated its crypto treasury, shedding over 90% of its $363 million holdings, including significant positions in ETH, WBTC, AAVE, ENA, and LINK on February 3.

The project moved most of its assets to Coinbase Prime and other exchange wallets, often routing through intermediary addresses. Meanwhile, the project has been receiving small ETH deposits from newly created or inactive wallets.

Current Market Status

As of now, Ethereum (ETH) is trading at $2,720, with an intraday high of around $2,900 and a low of approximately $2,500. This development highlights the volatile nature of the crypto market and the potential impact of high-profile endorsements and global economic news on cryptocurrency prices.

For those interested in staying up-to-date on the latest cryptocurrency news and trends, Global Crypto News offers a wealth of information and insights. Some key takeaways from this event include:

- High-profile endorsements can significantly impact cryptocurrency prices.

- Global economic news, such as trade tariffs, can influence the crypto market.

- The volatile nature of the crypto market requires investors to stay informed and adapt to changing circumstances.

Stay informed about the latest developments in the world of cryptocurrency and finance with Global Crypto News.