Ethereum’s price has been on a downward trajectory this year, hovering near its lowest level since September last year. The cryptocurrency was trading above $2,200 at last check, down by over 45% from its highest point in November last year.

Understanding the ETH Price Crash

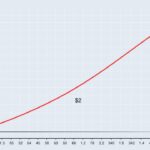

The Ethereum price crash can be attributed to several crucial charts that provide insight into the current market trends and what to expect this year. One such chart is the weekly chart, which shows that the ETH price formed a triple-top pattern.

The Triple-Top Pattern

This pattern is characterized by three peaks and a neckline, and is one of the most bearish patterns in the market. The ETH price found strong resistance at around $4,000 in 2024 and has now dropped to the neckline at $2,150. A clear break below that level risks more downside, potentially to $1,176, down by 45% from the current level.

Spot ETH ETFs Experience Outflows

Meanwhile, spot ETH ETFs have had substantial outflows in the past few weeks. Although these funds have attracted cumulative inflows of $2.82 billion, it’s a much smaller figure compared to Bitcoin’s $38 billion.

Ethereum Staking Outflows Rise

The ETH price crash has also been attributed to rising staking outflows. Data shows that the staking market cap has dropped by 20% in the last seven days to $74.5 billion. It has had outflows in the last four straight days.

A good example of this is Lido, the biggest liquid staking network in the crypto industry. Lido’s total value locked has dropped from over 10.1 million ETH to 9.41 million.

Ethereum Balances on Exchanges Rise

Further, there are signs that more investors are selling their ETH coins. One way of finding this is to consider the balances on exchanges. Data shows that the balances have risen in the past few days, reaching 15.40 million, the highest level since Feb. 1.

Ethereum Fees Drop

Ethereum’s price has dropped because it is no longer the most profitable player in the crypto industry. Ethereum has made $198 million this year, meaning that it has been overtaken by other players in the crypto industry like Uniswap, Circle, Solana, Jito, and Tron.

Key Takeaways

Investors should be aware of the following trends in the Ethereum market:

- Ethereum’s price has formed a triple-top pattern, indicating a potential bearish trend.

- Spot ETH ETFs are experiencing outflows, which could impact the price of Ethereum.

- Ethereum staking outflows are rising, which could lead to a decrease in the staking market cap.

- Ethereum balances on exchanges are rising, indicating that more investors are selling their ETH coins.

- Ethereum fees have dropped, making it less profitable compared to other players in the crypto industry.

As the Ethereum market continues to evolve, it’s essential to stay informed about the latest trends and developments. Stay tuned for more news and updates on Global Crypto News.

Stay ahead of the curve with the latest cryptocurrency news and updates on Global Crypto News.