Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Ethereum Gas Fees Hit Record Low: What It Means for the Ecosystem

In mid-August 2024, Ethereum gas fees dipped to 0.6 gwei—a record low since 2019. While some see this as a concerning drop, it is symptomatic of broader, healthier shifts within the ecosystem.

Understanding Lower Gas Fees

Lower gas fees reflect decreased mainnet transaction volume, which has, in turn, led to reduced staking yields for validators. Simultaneously, the slow adoption of Ethereum exchange-traded funds (ETFs) in the US adds to the market’s uncertainty. These recent events have prompted some to question Ethereum’s viability and long-term future. However, these developments indicate a new chapter in Ethereum’s evolution, marking a transition to a more mature and sustainable ecosystem.

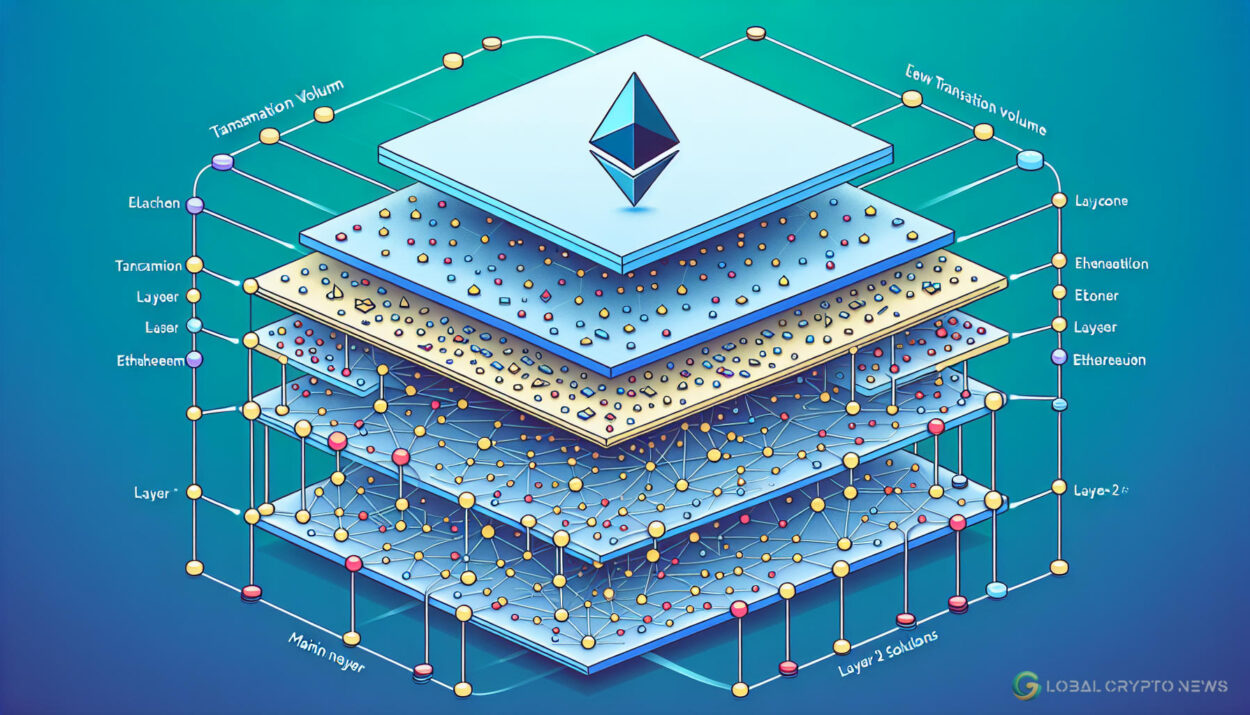

The reduced yields should not be viewed as a sign of diminished activity or liquidity but as a result of Ethereum’s success in scaling and distributing its load across layer-2 (L2) solutions. This shift, alongside new investment vehicles like spot ETH ETFs, is creating a more efficient and accessible market, bringing long-term benefits to Ethereum and decentralized finance (DeFi) as a whole.

Ethereum’s Paradoxical Growth

Ethereum is currently experiencing what can best be described as paradoxical growth. On the one hand, its mainnet is seeing reduced transaction activity and lower yields. On the other hand, L2 solutions—designed to reduce transaction congestion—are flourishing. Daily transactions across L2 ecosystems surged to an all-time high of 12.42 million in mid-August, coinciding with the lowest gas fees seen on the Ethereum mainnet in years. These dynamics reveal that rather than a slowdown in the ecosystem, Ethereum is shifting its activity to more scalable, efficient layers.

The lowered staking yields for validators, which many are concerned about, are a natural consequence of this migration of activity from the mainnet to L2s. Over time, Ethereum’s mainnet may evolve into a settlement layer reserved for high-value transactions, allowing the bulk of lower-value activity to be handled by L2s. This isn’t a sign of decline but of a maturing market capable of meeting the demands of a growing user base while optimizing costs and efficiency.

Instead of focusing narrowly on the mainnet’s yield, stakeholders should consider Ethereum’s ecosystem as a whole. Attracting more users to the protocol, enhancing accessibility, and rolling out initiatives like incentivized airdrops and points systems could help Ethereum further solidify its position as the go-to platform for decentralized applications and DeFi innovations.

The Expanding Influence of DeFi

Ethereum’s role as the foundational layer of DeFi continues to shape the broader blockchain space. Despite current concerns, Ethereum’s growth remains a powerful driver of innovation, and this evolution is crucial for the future of decentralized finance.

On the protocol level, Ethereum’s continued development and expansion create a more competitive and accessible network for users and developers alike. As Ethereum scales, its capability to support new dApps and financial products increases, further contributing to DeFi’s success. This, in turn, drives network effects, where increased participation enhances security, utility, and, ultimately, adoption.

Ethereum’s influence is also spreading to traditional finance, most notably through the introduction of spot ETH ETFs, which provide a more familiar and regulated entry point for institutional and retail investors alike. These ETFs lower the entry barrier for those unfamiliar with blockchain technology but eager to invest in the space. By offering a regulated framework and a product perceived as safer than direct token purchases, spot ETH ETFs are attracting traditional investors to the Ethereum ecosystem. This not only expands Ethereum’s reach but also positions ETH as more than just a tech-driven asset—transforming it into a recognized store of value.

As this trend continues, we can expect further integration between Ethereum and real-world assets, enhancing the network’s utility and long-term potential.

Supporting Ecosystem Transitions

As Ethereum navigates this paradigm shift, it’s important to recognize that these changes are a natural part of the ecosystem’s evolution. Lowered staking yields and gas fees are not indications of failure but reflections of Ethereum’s capacity to adapt and scale. Supporting this transition is crucial for the network’s long-term success, and this can be achieved through initiatives that prioritize user engagement and developer incentives.

For instance, platforms like Base—an L2 solution—handled over 109 million transactions in the past 30 days compared to Ethereum’s 33 million. This is a clear sign that L2s play a critical role in the network’s growth. However, acknowledging this shift isn’t enough; the ecosystem must prioritize collaboration among DeFi protocols to build dApps that maximize Ethereum’s potential. This is the only way for Ethereum to achieve its actual goal of serving the masses with decentralized technology.

A New Dawn for Ethereum

The Ethereum mainnet’s lower yields and gas fees may appear to signal a slowdown, but they are, in fact, signs of Ethereum’s growing scalability and efficiency. As L2 networks take on more transaction activity and new financial products like spot ETH ETFs open the door for traditional investors, Ethereum is evolving into a more robust and versatile platform.

The ebbs and flows of market dynamics—like the recent yield reductions—are part of a larger shift that strengthens Ethereum’s role as the backbone of DeFi. The future of Ethereum lies in its ability to scale, integrate real-world assets, and foster a thriving community across its ecosystem. Far from being a calamity, the lower yields signal a new dawn in which Ethereum continues to lead the way in decentralized innovation.

“Ethereum’s lower yields and gas fees are not a sign of decline but a testament to its evolving scalability and efficiency.”

Encourage readers to explore more news on Global Crypto News.

#CryptoAssets #AI #CryptoTech