Trump’s Tariffs Send Shockwaves Through Crypto Markets

Global financial markets are in turmoil once again, with U.S. President Donald Trump’s latest tariff announcement sending shockwaves across stocks, commodities, and cryptocurrencies. The crypto market, already under stress, has experienced a sharp decline, with the total market cap dropping over 8% in the last 24 hours.

Trump Doubles Down on Tariffs

The U.S. president on February 27 announced a new 10% tariff on Chinese goods—on top of the existing 10% levies—alongside a looming 25% duty on imports from Canada and Mexico. Investors reacted swiftly, hitting the panic button as these measures deepened market uncertainty.

Crypto Market Suffers Sharp Decline

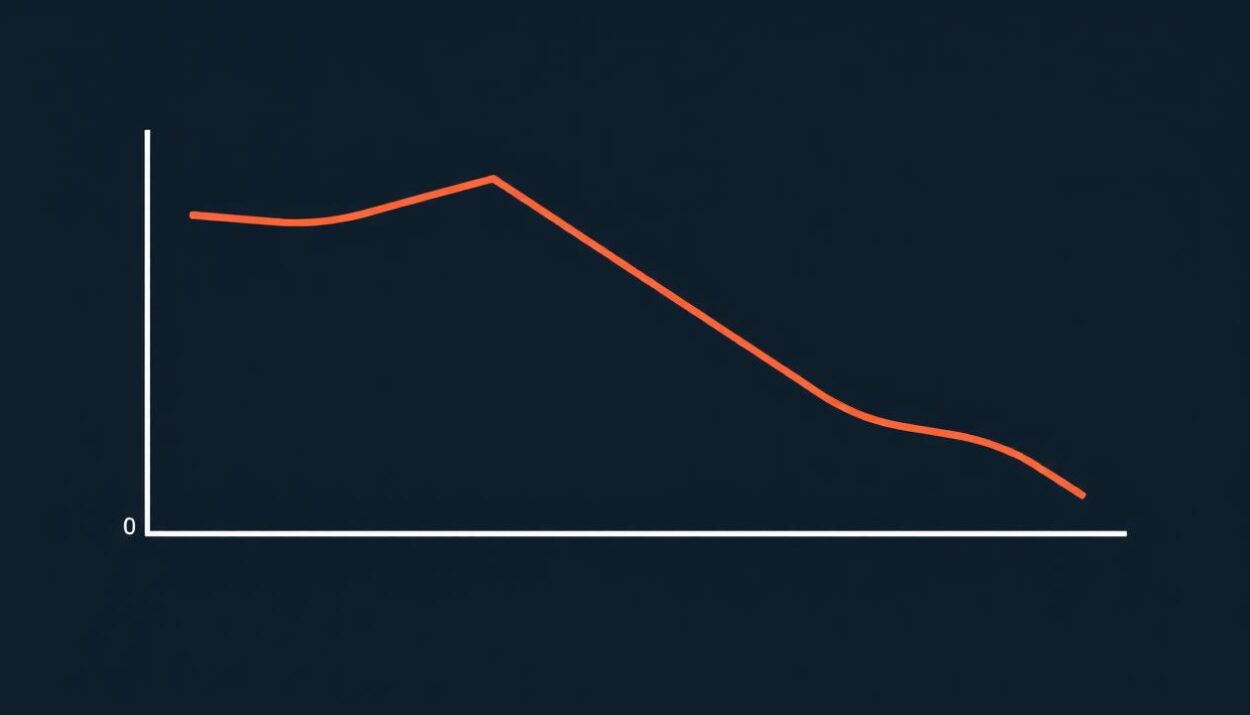

The crypto market has experienced a sharp decline, with Bitcoin, the market leader, suffering one of its steepest drops in months. As of February 28, Bitcoin has plunged nearly 8% to trade around $80,000. Altcoins have fared even worse, with many seeing double-digit losses as traders rushed to cash out.

How Trade Tariffs Could Set Off a Chain Reaction in Crypto

Trade wars are rarely isolated events. They ripple across financial markets, shifting liquidity, reshaping inflation expectations, and forcing central banks to recalibrate their policies. If Trump follows through with his tariffs on Mexico and Canada while also imposing additional 10% levies on China, the outcome could set off a full-scale inflationary shock, putting the Federal Reserve in a tough spot and potentially deepening the sell-off in crypto markets.

The core issue is that tariffs act as a tax on imported goods. When businesses face higher costs on foreign products, they don’t absorb the losses—they pass them on to consumers. This leads to a surge in the price of everyday goods, from electronics to food, fueling inflation.

Impact on Retail and Institutional Investors

The market’s reaction to tariffs wouldn’t just hinge on inflation; it would also be driven by sentiment and positioning. Right now, Bitcoin ETFs play a crucial role in capital flows within the crypto market, and their behavior indicates that investors are already on edge.

Outflows have dominated for eight consecutive trading days as of February 27, totaling $3 billion, including a single-day record withdrawal of $1 billion on February 25—the highest ever. This pattern suggests that retail traders, who make up a significant portion of the market, are moving in herds, exiting en masse when volatility spikes.

Where Does Crypto Go from Here?

The crypto market finds itself at a crossroads, caught between short-term panic and long-term positioning. With Bitcoin plunging 26% from its highs and the fear and greed index hitting levels last seen during the Luna collapse, sentiment is extremely bearish.

We are making lower lows in this current wave. I was tempted to add risk this morning, but looking at this price action I think we have one more violent wave down below $80k, most likely over the weekend, then crickets for a while. Hold on to your butts!

Analysts are divided, but a common thread runs through their assessments: this downturn may not last much longer.

Technical Analysis Points to Potential Inflection Points

Technical analysts are also spotting potential inflection points. Edward Morra notes that Bitcoin is nearing the completion of a key CME breakout gap from last year.

We almost filled the CME breakout gap from last year. I know market looks absolutely rekt but thats actually good news, we now have a gap to fill higher (~$93k), so I think the bounce is pretty close.

Michaël van de Poppe focuses on sentiment, pointing out that fear has reached extreme levels at a time when the U.S. government is more pro-crypto than ever.

#Bitcoin is down 25%. The #Crypto fear & greed index hits 10. The fear & greed index is as low as during the Luna collapse. The government in the U.S. is massively pro-crypto. I would say that this is going to reverse quickly in the next 1-2 weeks and the bottom is close.

Tips for Traders

For now, traders should remain cautious. Fear may be a contrarian signal, but blindly assuming a reversal could be just as risky. The golden rule remains:

- Trade wisely.

- Never invest more than you can afford to lose.

Stay up-to-date with the latest news and analysis on the crypto market by visiting Global Crypto News.