Cronos Breaks 3-Month Downtrend Amid Reserve Proposal and ETF Plans

Cronos Proposal Sparks CRO Price Rally

Cronos, the Layer 1 blockchain associated with crypto exchange Crypto.com, has proposed the establishment of a Cronos Strategic Reserve wallet. This move aims to reissue the 70 billion CRO tokens that were burned in 2021, restoring the total token supply to its original 100 billion CRO. The burning event, one of the largest in crypto history, reduced the supply from 100 billion to 30 billion CRO tokens to support decentralization efforts ahead of Cronos’ mainnet launch.

Cronos Reserve and ETF Plans

The Cronos reserve, subject to a new 5-year vesting period, will fund the project’s roadmap, including plans to pursue a spot ETF launch by the end of 2025. Voting for the proposal ends on March 17, with over 99.76% of votes currently favouring the move. The Cronos reserve will also support “America’s ambition to become the World Capital of Crypto,” a statement that has caught traders’ attention amid the overall crypto market surge.

CRO Price Analysis: Bearish Outlook in the Short Term

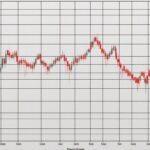

Technical indicators suggest a bearish outlook for CRO in the short term. The 1-day CRO/USDT price chart shows that CRO has broken up above the descending trendline formed since Dec. 17, but the 200-day moving average remains above the 50-day MA, signalling weak recent price action and strong bearish pressure.

Tips for CRO Investors:

- Monitor the 200-day moving average and 50-day MA for signs of a trend reversal.

- Keep an eye on the Supertrend Indicator and Relative Strength Index for momentum signals.

- Be cautious of potential price dilution due to the increased token supply.

Cronos Price and Social Sentiment

At press time, CRO was exchanging hands at $0.084 per coin, with positive social sentiment per Santiment data. However, the price action could switch back to its bearish trend in the coming days if the current hype fades.

For more news and updates on the cryptocurrency market, visit Global Crypto News.