Chainlink Price Analysis: Three Key Reasons for a Potential Bounce Back

The Chainlink price has experienced a significant downturn this year, continuing a trend that started in December when it peaked at a multi-year high of $30.78. The price of LINK has plummeted to $17.4, down by 43% from its highest level in December, mirroring the decline of other altcoins in recent months.

Reason 1: Falling Centralized Exchange Balances

Despite the price drop, there are signs that many Chainlink holders are not selling their coins. One indication of this is the continued decline in balances on exchanges. According to CoinGlass data, these balances have dropped to 138.8 million LINK coins, the lowest level since September last year. This decrease is a sign that investors are optimistic about the coin and are holding them steady in their self-custody wallets.

Reason 2: Expected Approval of a Spot LINK ETF

The confidence among Chainlink holders is likely due to the expectation that the Securities and Exchange Commission will approve a spot LINK ETF later this year. Such a fund would lead to more inflows and boost the price of LINK. Additionally, Chainlink’s positioning in the crypto industry as the largest oracle network, with a total value secured (TVS) figure of $35 billion, is a significant factor in its potential price rebound.

Reason 3: Strong Technicals and Industry Positioning

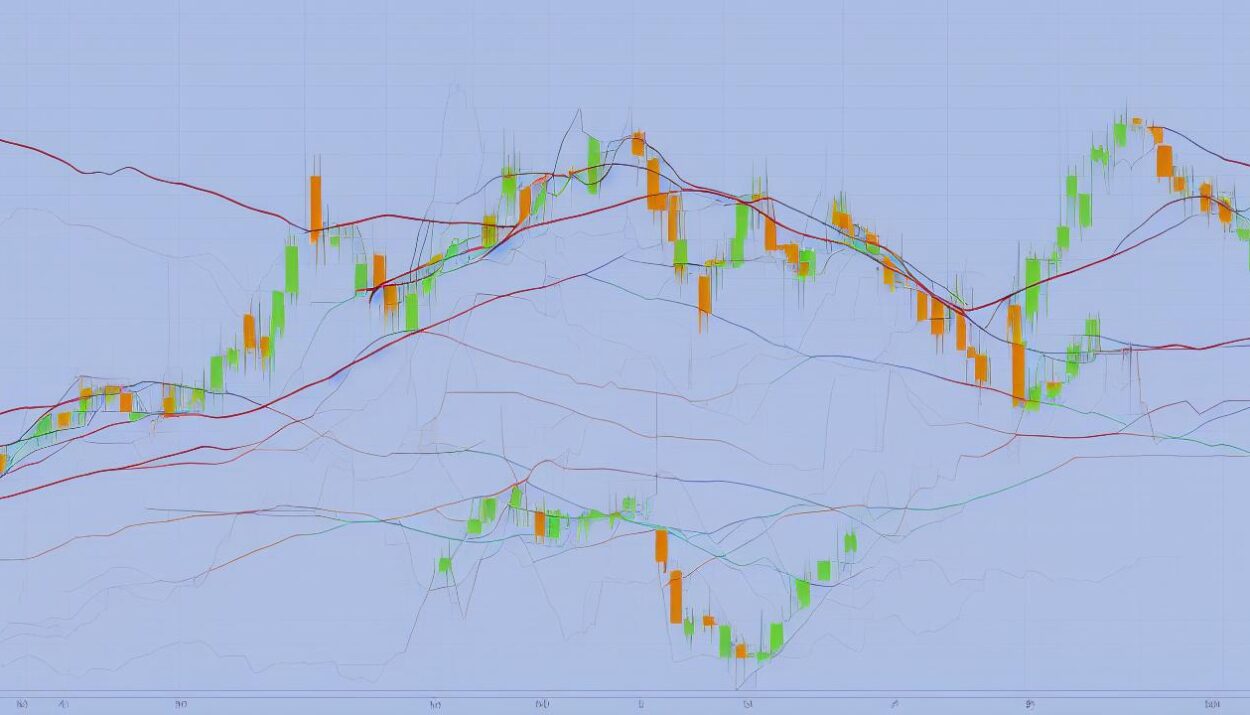

Chainlink’s technical analysis also suggests a potential bounce back. The weekly chart shows that LINK has remained slightly above the 100-week Exponential Moving Averages, even after crashing by 43% from its highest point in November. Furthermore, LINK has formed a giant megaphone chart pattern, which is characterized by two diverging trendlines. In most cases, this pattern leads to a strong bullish breakout. The initial target of a rebound will be the November high of $30, followed by the 61.8% retracement point of $35.

Tips for investors:

- Keep an eye on centralized exchange balances, as falling balances can indicate investor optimism.

- Monitor the approval of a spot LINK ETF, which could lead to increased inflows and a price boost.

- Analyze Chainlink’s technicals, including its position above the 100-week Exponential Moving Averages and the megaphone chart pattern.

As the crypto market continues to evolve, it’s essential to stay informed about the latest developments and trends. For more news and updates on Chainlink and other cryptocurrencies, visit Global Crypto News.