BN Fondos Launches First Bitcoin and S&P 500-Focused Investment Funds in Central America

BN Fondos has become a pioneer in Central America’s financial sector by launching the region’s first Bitcoin and S&P 500-focused investment funds. The introduction of these funds provides investors with an opportunity to diversify their portfolios and gain exposure to global markets through exchange-traded funds.

Investment Opportunities and Digitalization

According to Pablo Montes de Oca, general manager of BN Fondos, “These funds not only present an attractive investment opportunity but also represent a crucial step toward digitalization.” The company’s commitment is to offer innovative products that benefit clients and encourage new generations to invest.

BN ETF 500 and BN ETF Bitcoin: Key Features

The BN ETF 500 is designed for long-term investors seeking exposure to the S&P 500, an index that tracks the 500 largest publicly traded companies in the U.S. This fund enables Costa Rican investors to access a broad market portfolio without the need to manage individual stocks. The key features of the BN ETF 500 include:

- No exit fees, allowing for flexible investment management

- Long-term investment opportunities

- Exposure to the S&P 500 index

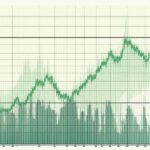

The BN ETF Bitcoin, on the other hand, provides exposure to Bitcoin through ETFs, enabling investors to participate in the crypto market without directly holding digital assets. To manage liquidity, the fund may also invest in U.S. and Costa Rican government securities denominated in U.S. dollars.

Bridging the Gap Between Traditional Finance and Digital Assets

By launching these funds, BN Fondos aims to bridge the gap between traditional finance and digital assets, making innovative investment products more accessible. Currently, Costa Rica ranks 92nd out of 155 countries in global crypto adoption.

For more news and updates on the cryptocurrency market, visit Global Crypto News. Stay informed about the latest developments in the world of Bitcoin, blockchain, and digital assets.