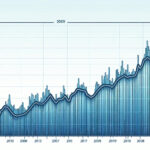

Bitcoin’s price surged to a record high above $73,000 on March 12, signaling a new era of price discovery for the cryptocurrency. Despite reaching historic peaks, institutional demand for Bitcoin continues to rise, with major catalysts driving the latest price upswing.

Market data analysis reveals that Bitcoin’s market supply is tightening as investors transfer BTC to cold storage, leading to a scarcity in the market. This scarcity contributed to Bitcoin’s market capitalization briefly surpassing $1.5 trillion on March 12, with prices hitting a global peak of $72,967.

Bullish announcements from institutional giants like BlackRock and MicroStrategy played a significant role in driving the latest price surge. BlackRock’s plans to incorporate spot Bitcoin ETFs into its portfolio, as outlined in a recent filing with the SEC, sparked hopes of increased demand for Bitcoin. Meanwhile, MicroStrategy CEO Michael Saylor announced the purchase of an additional 12,000 BTC, bringing the company’s total holdings to 205,000 BTC.

On-chain data analysis further supports the positive price trend, with traders’ reactions triggering the uptick in price. Exchange netflow data shows that investors moved 4,470 BTC worth $520 million from exchange-hosted wallets into cold storage on March 11. This shift indicates a long-term investment strategy, as investors opt for cold storage over short-term profit-taking opportunities.

The decrease in available coins for trading, coupled with rising market demand, has put upward pressure on Bitcoin’s price, which was trading around $72,000 on March 12. With over $520 million worth of BTC withdrawn from the market supply in the last 24 hours, Bitcoin’s price could potentially surpass $75,000 in the near future.

Critical market trends suggest that Bitcoin’s price is on the brink of another significant increase, with virtually all Bitcoin holder addresses now in a profitable position. This scenario, combined with strong institutional demand from companies like MicroStrategy and BlackRock, could lead to a bullish cycle of declining market supply.

In the event of a bearish pullback, strong support is expected at the $68,560 zone, where over 6.6 million existing holders have acquired 2.9 million BTC. With positive sentiment and support from key stakeholders, Bitcoin’s price could quickly rebound from any potential downturns.

As Bitcoin continues its upward trajectory, investors and traders are closely watching for the next milestone price target at $75,000. With bullish tailwinds in play, Bitcoin bulls remain optimistic about the cryptocurrency’s future price movements. For more news and updates on Bitcoin and other cryptocurrencies, continue exploring Global Crypto News.