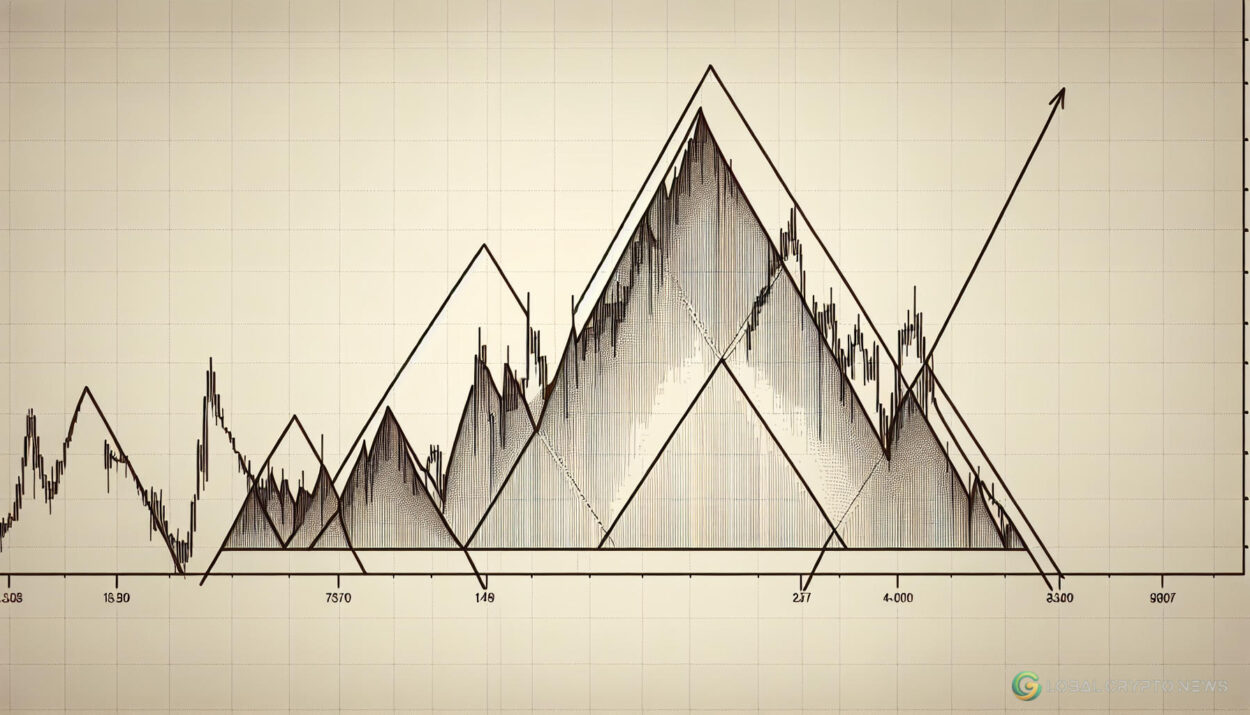

Bitcoin’s price has recently formed a notable chart pattern that could drive it significantly higher in the coming months, according to well-known technical analyst Peter Brandt. In a recent post, Brandt highlighted that Bitcoin has developed a bullish chart pattern known as an inverted right-angled broadening triangle, a concept introduced by Richard Schabacker in 1934.

This pattern, often referred to as a falling broadening wedge, typically leads to a strong bullish breakout over time. It is characterized by two descending trendlines. In Bitcoin’s case, the upper side of the wedge was created by connecting the highest points in March, May, June, and July, while the lower side linked the lowest levels in those months.

This pattern has proven effective in the past, notably during the first quarter of 2020 when the COVID-19 pandemic began spreading rapidly worldwide. Additionally, Bitcoin has formed a hammer candlestick pattern, identified by a long lower shadow and a small body. To confirm the right-angled broadening triangle pattern, Bitcoin needs to maintain its position above the lower side of the hammer. A drop below this point would invalidate the pattern and could lead to further downside.

Potential Catalysts for Bitcoin

For this bullish pattern to materialize, Bitcoin will require a significant catalyst. Similar to March 2020, this catalyst could come from the Federal Reserve. Recently, Chicago Fed President Austan Goolsbee indicated that the Fed would intervene if the economy slips into a recession. Intervention could involve interest rate cuts and potentially quantitative easing.

There are indicators suggesting a recession might be imminent. On August 6, reports highlighted the Sahm Rule, which monitors the jobless rate. The unemployment rate has risen for four consecutive months, the longest streak since the 2008 Financial Crisis. Historically, every time the unemployment rate has increased for four straight months over the past 75 years, the US economy has entered a recession.

The US unemployment rate has risen for 4 consecutive months, the longest streak since the 2008 Financial Crisis.

Stay updated with the latest cryptocurrency news and trends on Global Crypto News.