Bitcoin’s Current Price Action Signals Potential Bullish Continuation

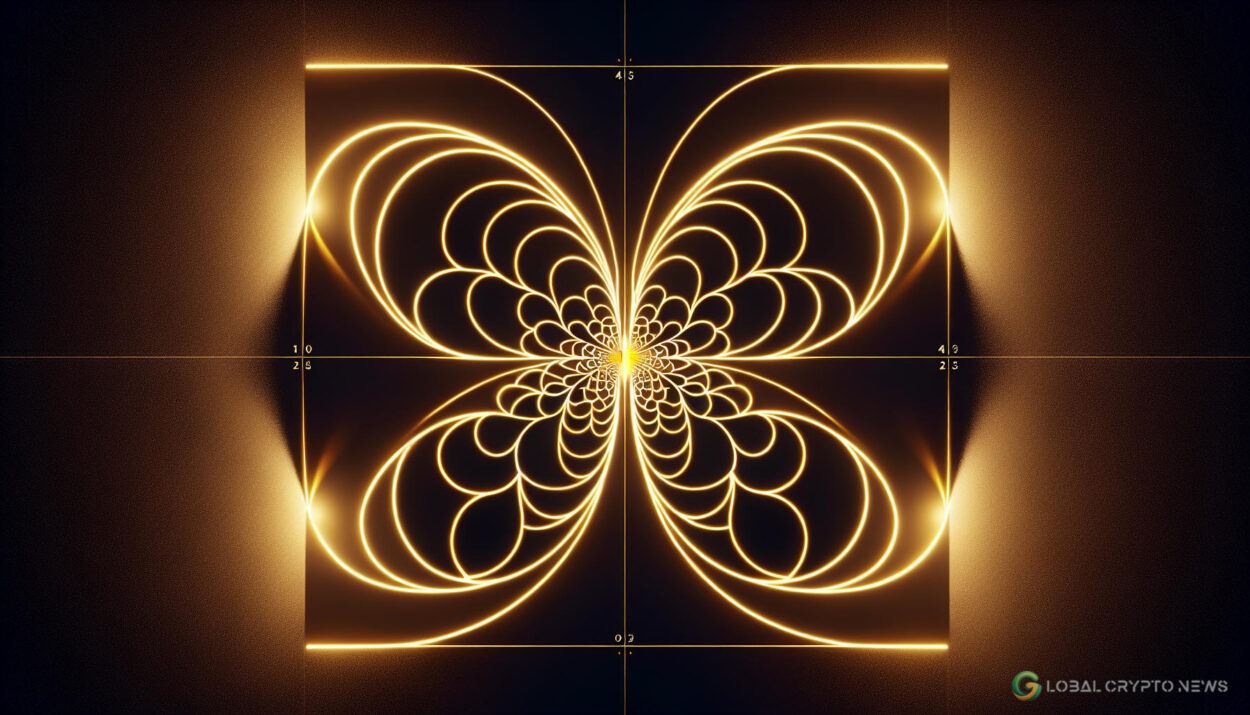

Bitcoin is navigating a crucial support zone with strong technical confluence, showing signs of forming a rare Butterfly Harmonic Pattern. If the current level holds and the pattern completes its symmetry, Bitcoin could potentially target $113,000.

Bitcoin’s Recent Performance Overview

Bitcoin (BTC) has entered a corrective phase after a robust bullish trend earlier this quarter. This retracement has brought the price into a critical support zone at approximately $104,600, a level reinforced by multiple technical indicators. While some traders interpret this consolidation as market indecision, technical analysis suggests it could be setting the stage for a structured continuation move.

Key Technical Levels and Indicators

- $104,600 High Time Frame Support: This zone is supported by the confluence of the Point of Control (POC), VWAP SR, and the 0.618 Fibonacci retracement level.

- Butterfly Harmonic Pattern Structure: The price action meets all harmonic requirements between legs B and C, with accurate Fibonacci alignment.

- Symmetry Confirmed: The pattern maintains proportional symmetry, which is essential for harmonic setups to remain valid and predictive.

The Butterfly Harmonic Pattern in Focus

Bitcoin is currently aligning with the Butterfly Harmonic Pattern, a rare but highly structured technical setup. This pattern is characterized by specific Fibonacci ratios between its legs, particularly from points B to C and C to D. These criteria are being met as Bitcoin trades near the golden 0.618 Fibonacci level, forming a potential pivot zone.

“The Butterfly Harmonic Pattern requires mathematical precision, making it a reliable tool for projecting price movements.”

If this support zone holds and a bullish reversal emerges on lower timeframes, Bitcoin could complete leg C and initiate leg D of the pattern. The projected target for leg D is approximately $113,000, providing a confluence between Fibonacci-based projections and broader market structure analysis.

Why This Pattern Matters

Harmonic patterns like the Butterfly are especially significant during retracements within broader bullish trends. These patterns often signal structured continuation moves, provided the technical framework remains intact. Despite recent price corrections, Bitcoin has not invalidated its macro bullish structure, maintaining the potential for upward momentum.

What to Watch For in Upcoming Price Action

Traders should closely monitor Bitcoin’s behavior around the $104,600 support zone. If this level holds and lower timeframe signals confirm a bullish reversal, the next leg of the Butterfly Harmonic Pattern could be triggered. This movement would aim for a rally toward $113,000, completing the D leg and concluding the pattern.

- Watch for confirmation signals such as bullish candlestick patterns or volume increases.

- Monitor Fibonacci retracement levels and broader market sentiment.

- Stay updated on macroeconomic factors that may influence Bitcoin’s price.

While the technical outlook supports a bullish continuation, traders should exercise caution and manage risk appropriately. The cryptocurrency market is inherently volatile, and patterns, while predictive, are not guarantees.

Stay informed on the latest updates in the crypto market to make educated investment decisions.