Bitcoin’s Value Surpasses Major Currencies by 99.5%: A New Era for Digital Assets?

The global economy has been grappling with challenges like inflation and slow growth post-pandemic. Recent reports in the U.S. reveal a Q1 GDP growth of 1.6%, falling short of expectations and core PCE inflation rising by 3.7% annually in Q1.

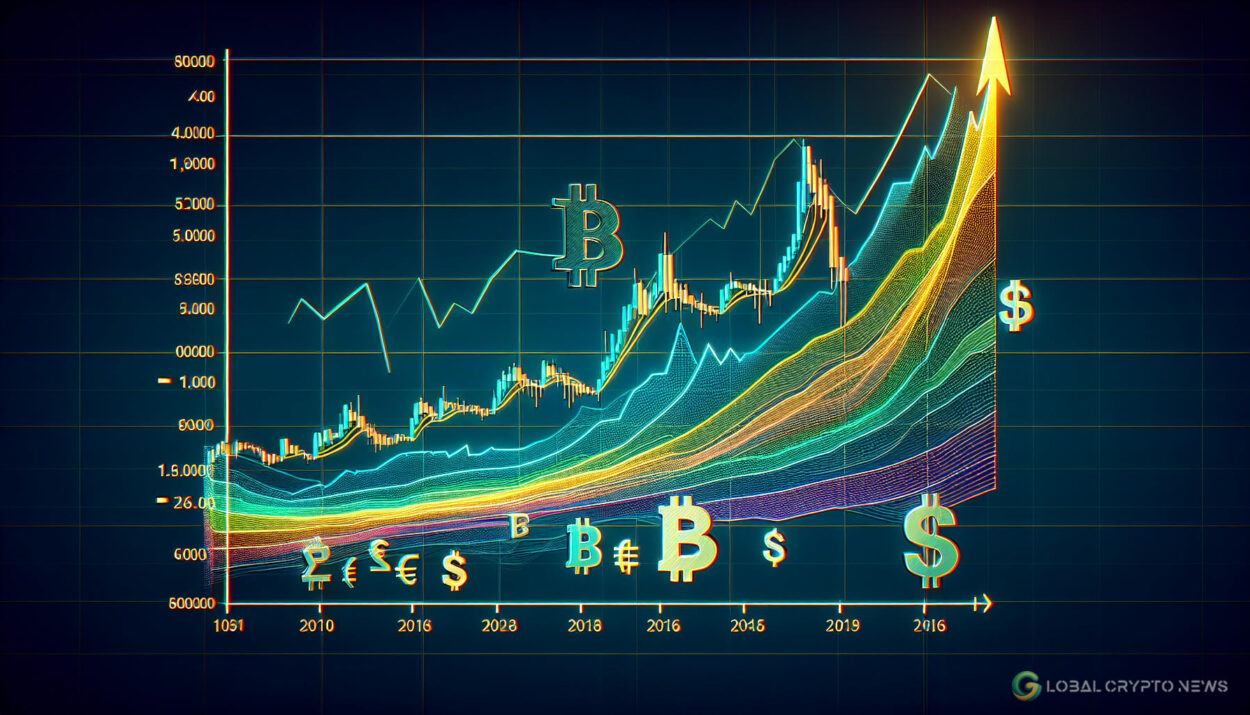

Bitcoin (BTC) has been making headlines with its price reaching around $62,000 on April 29. The decentralized nature of BTC has sparked debates on its potential as a store of value. Supporters see it as a hedge against inflation, while critics cite price volatility and regulatory concerns.

Bitcoin vs. USD: A Shift in Power

The U.S. dollar’s purchasing power has dwindled against Bitcoin, standing at 0.000016 BTC on April 29, marking a 99.5% decrease in value. Bitcoin’s value has surged by nearly 800% against the dollar in the past five years.

BTC vs. Other Global Currencies

Analyzing Bitcoin’s performance against major global currencies like the Euro, British Pound, Chinese Yuan, Japanese Yen, and Argentine Peso shows a significant decline in value for these currencies against BTC.

Bitcoin as a Store of Value: A Historical Perspective

Reserve currencies like the British Pound and U.S. Dollar gained prominence due to economic stability, geopolitical power, and institutional trust. Bitcoin faces challenges like price volatility, regulatory hurdles, and security concerns in its quest to become a trusted store of value.

The Future of Bitcoin as a Store of Value

Bitcoin’s growth and decentralized nature offer resilience against government interference but raise concerns about stability and widespread adoption. Time will tell if Bitcoin can address these concerns and earn trust as a reliable store of value.

To learn more about earning Bitcoin through mining, trading, and other methods, stay tuned for more updates on Global Crypto News.