Bitcoin has been hovering near the $57,000 mark as market-wide fear subsides, yet a significant number of addresses remain at a loss.

Bitcoin swiftly bounced back from the $50,000 level on August 5, as concerns around geopolitical and recession issues began to ease. The leading cryptocurrency briefly reached a local high of $57,220 today and has been consolidating between $55,000 and $57,000 over the past 24 hours.

BTC gained 1.7% in the past 24 hours and is trading at $56,900 at the time of writing. Following this price surge, Bitcoin’s market cap exceeded the $1.1 trillion mark with a daily trading volume of $47.4 billion.

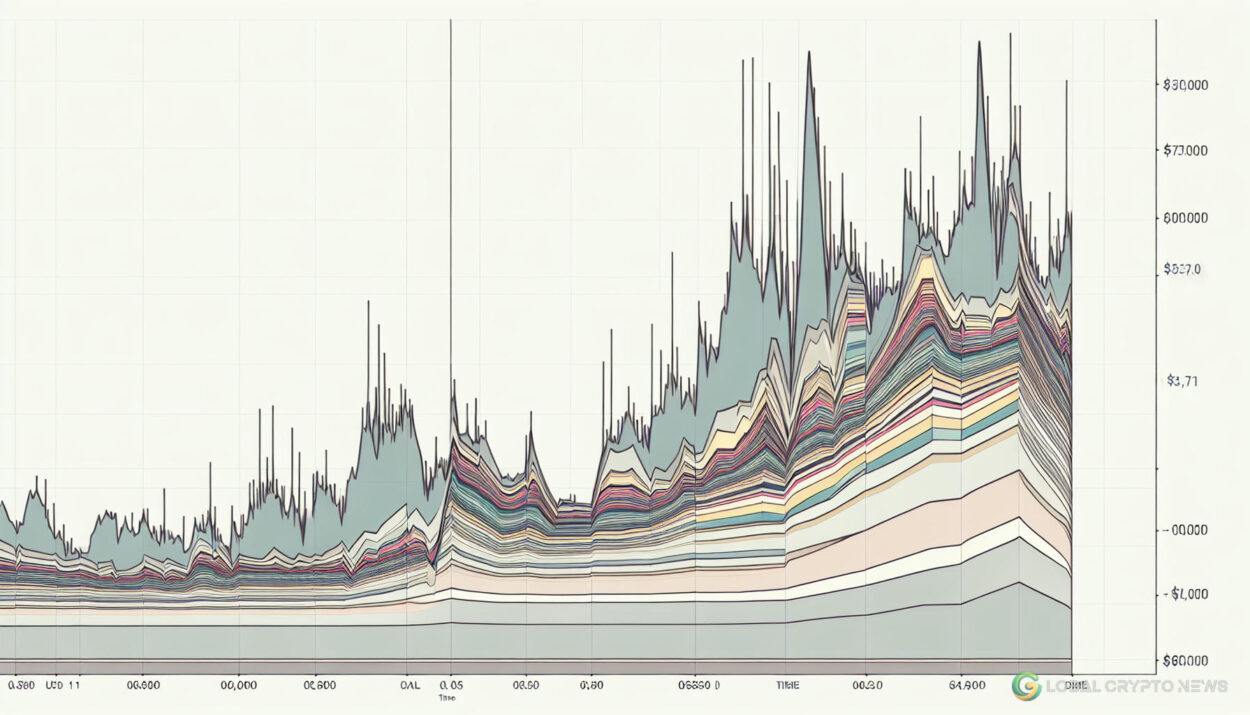

According to ITB data, 9.87 million Bitcoin addresses are still at a loss, with the majority, 6.88 million wallets, having acquired the asset at an average price of $66,441. Additionally, 2.99 million holders bought BTC at an average price of $59,978.

These addresses collectively hold a total trading volume of 4.53 million Bitcoins. At this price point, 1.27 million addresses, holding 907,070 BTC tokens, are either at a small loss or profit, having purchased Bitcoin at an average price of $55,776.

Conversely, 42.24 million addresses are seeing notable profits on their Bitcoin holdings. Data from ITB shows that 37.84 million addresses have been holding Bitcoin for over one year, while only 2.66 million addresses belong to short-term traders.

Lower selling pressure is expected from the addresses that are still at a loss, potentially resulting in lower price volatility and even a price increase.

According to a report, CryptoQuant CEO Ki Young Ju anticipates a new all-time high for Bitcoin if it remains above the $45,000 mark. He also highlighted that BTC whales have accumulated 404,448 coins, worth approximately $23 billion, over the past 30 days. This movement indicates increased accumulation while the market was experiencing FUD.

Stay updated with the latest cryptocurrency news and trends on Global Crypto News.