Bitcoin Price Holds Below $100,000: Experts Warn Against New Long Trades

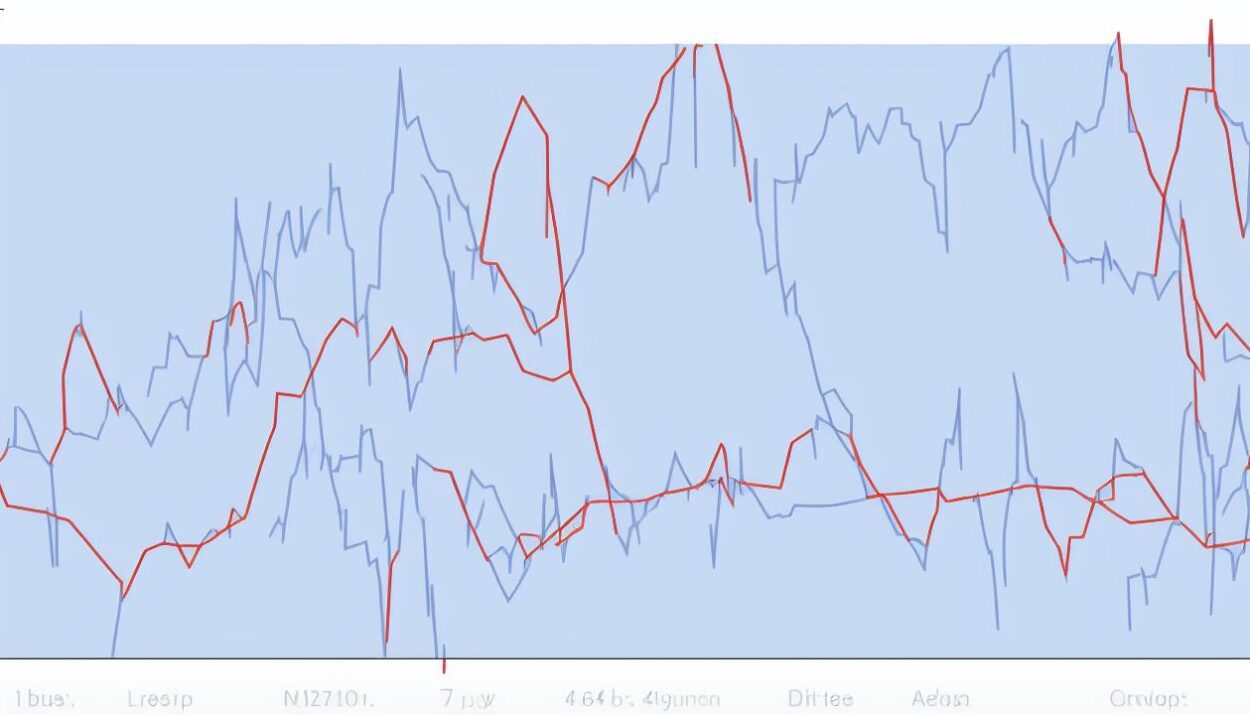

Despite Bitcoin’s recent jump past $102,000, analysts warn that the time may not be right for new long trades. The Relative Strength Index (RSI) has been consolidating, and with a current RSI of 48%, it’s still too high to trigger optimal market patterns for entry points.

Historical Buying Opportunities

“Bitcoin has historically presented strong buying opportunities only when the RSI dropped to around 40%,” analysts at Matrixport noted. This suggests that investors should stay patient and wait for a better buying opportunity.

The recent price surge on February 4 came after a significant drop due to concerns over President Donald Trump’s proposed tariff hikes. The fears of a trade war led to a massive liquidation of speculative bets, with over $2.3 billion in leveraged crypto positions being liquidated within 24 hours.

Market Conditions Remain Uncertain

With market conditions still uncertain, analysts recommend a more strategic approach:

“to exercise patience and wait for an optimal entry point.”

This cautious approach is essential for investors looking to make informed decisions in the current cryptocurrency market.

Before making any investment decisions, consider the following tips:

- Monitor the RSI and wait for it to drop to around 40% for optimal buying opportunities.

- Stay up-to-date with market news and analysis to make informed decisions.

- Exercise patience and avoid impulsive trades.

Stay informed about the latest developments in the cryptocurrency market and Bitcoin prices on Global Crypto News.