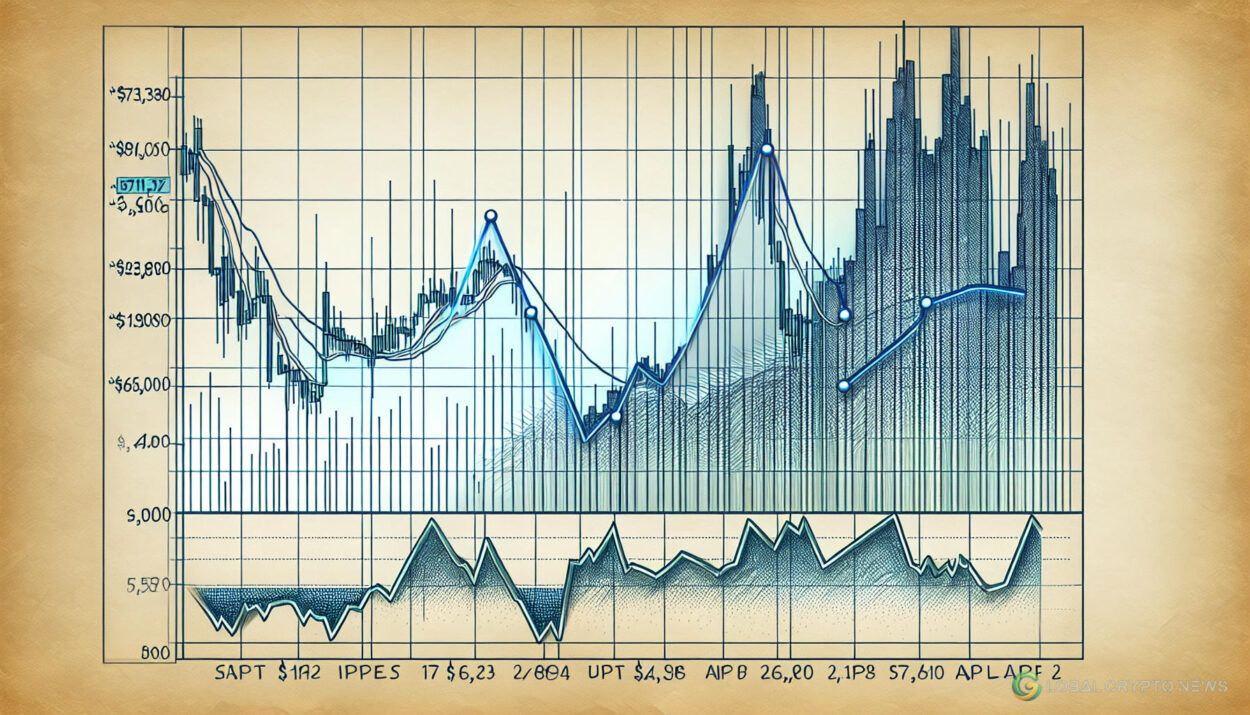

Bitcoin Price Drops Below $65,800: Will There Be a Rebound Before Halving?

Bitcoin faced a significant drop on April 2, falling below $65,800, resulting in leveraged bull traders experiencing over $130 million in losses. However, despite this decline, BTC network fundamentals and macro indices indicate a potential rebound in the near future.

Reasons Behind the Bitcoin Price Drop

The sudden drop in Bitcoin price from $71,317 to $65,800 on April 2 was primarily driven by negative performance in Bitcoin ETFs, with a total net outflow of $85.7 million on April 1. Grayscale’s GBTC saw outflows of over $302 million, exacerbating the market downturn.

Additionally, rapid liquidations in the derivatives markets further accelerated the decline, with over 140,290 traders experiencing $437.6 million in leveraged position liquidations within 24 hours. Long traders suffered the most significant losses, totaling $133.7 million.

Potential for Price Recovery

Despite the bearish impact of widespread liquidations, the market dynamics suggest that bull traders may initiate covering purchases to mitigate further losses. This, coupled with short traders booking profits, could alleviate the bearish pressure and lead to a potential price recovery.

Moreover, with no adverse changes in Bitcoin network fundamentals, a quick rebound in BTC price could be triggered by the actions of market participants responding to the recent liquidations.

Factors Supporting a Rebound

Recent statements from Fed Chair Jerome Powell, indicating no elevated risks of a U.S. recession, have eased fears and hinted at potential rate cuts. This news, combined with stable BTC fundamentals and positive social sentiment, suggests that the recent market downturn may have been driven by cascading liquidations.

BTC whales have shown resilience amid the market fluctuations, investing over $6.8 billion to acquire 100,000 BTC in the last 30 days. Despite the price drop on April 2, whales continue to hold onto their acquisitions, signaling confidence in a potential rebound.

Price Forecast and Outlook

With BTC whales holding significant positions and positive remarks from the Fed Chief, there is optimism for a price rebound above $70,000 before the upcoming Halving event. To validate this prediction, BTC bulls must prevent further declines below $65,000 and aim to reclaim the $70,000 area.

Additionally, monitoring the behavior of retail traders and the upcoming Non-Farm Payrolls (NFP) report on April 5 could provide further insights into potential bullish activity in the market, leading to a recovery phase before Halving.

In conclusion, while the recent price drop may have caused concerns, the overall market sentiment and key indicators suggest a possible rebound in Bitcoin price in the near future. Stay informed and monitor market developments closely for potential opportunities.