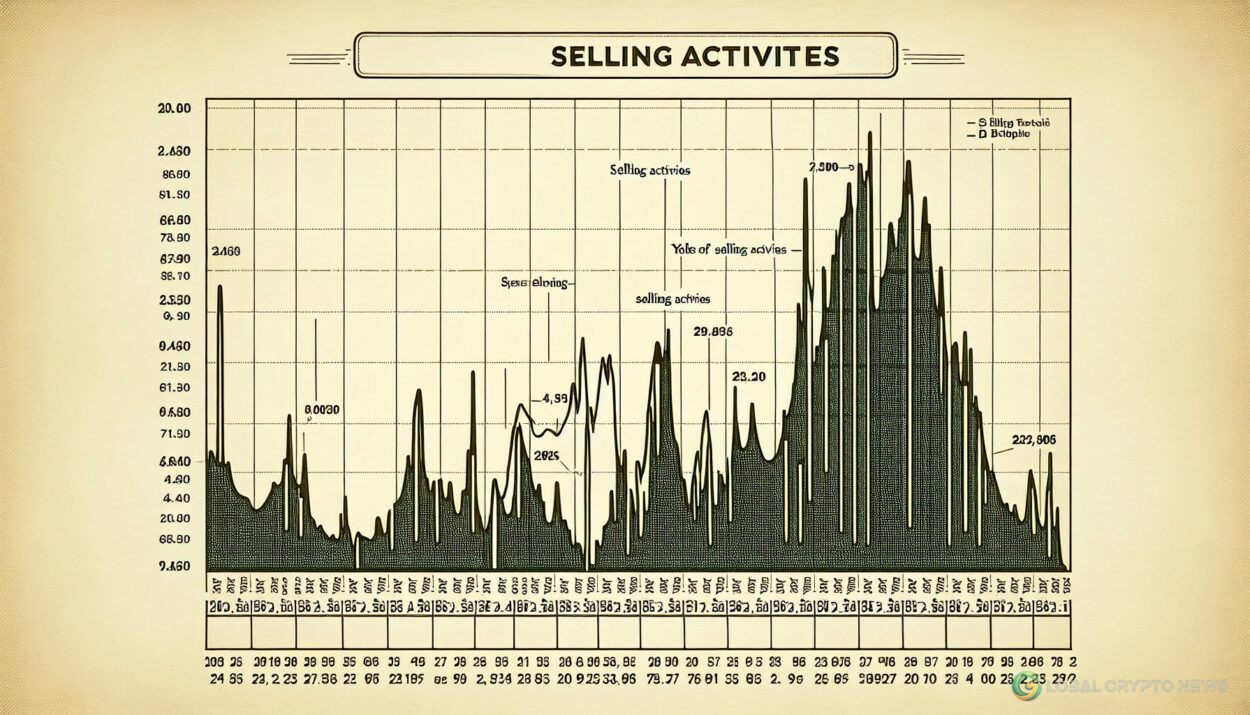

Bitcoin miners are selling their holdings as the fourth halving approaches, according to CryptoQuant. As BTC continues its bull run, miners are selling their holdings to monetize their business operations and buy more equipment for profitability. CryptoQuant CEO Ki Young Ju published a graph of miners’ selling activity since 2012, noting that the bull market would continue unless ETF inflow slows down. U.S. mining companies are not the main Bitcoin sellers so far, suggesting that the top sellers “are likely offshore or older miners.” However, analysts are confident that increased selling activity by miners is unlikely to impede Bitcoin’s upward momentum, given the substantial inflow of fresh capital through spot ETFs. Despite Bitcoin miners achieving record daily revenues of $78.6 million, out of the 26 public Bitcoin miners, only three have posted positive returns year-to-date. Bitcoin’s fourth halving is anticipated to arrive in mid-April this year, cutting the block reward from 6.25 BTC to 3.125 BTC.

Global Crypto News

Learn about the different aspects of Cryptocurency from experts in the field.

Account Security AI blockchain Algorithmic Stablecoins Amazon Bitcoin Holdings Arbitrum DeFi Asset Tokenization ASX Bitcoin ETF Australian crypto regulations Australian Securities and Investments Commission BabyDoge Binance Listing binance bitcoin Bitcoin ETFs UAE Bitcoin Halving Bitcoin mining Bitcoin money laundering Bitcoin NFTs Bitcoin Spot ETFs Bitcoin vs Ethereum Bitwise XRP ETF BlackRock Blockchain analysis Brett meme coin Coinbase Cryptocurrency Decentralized Finance Dogecoin Ethereum ETF Ethereum ETFs Ethereum Solana Federal Reserve Global Crypto Regulations Hong Kong Institutional investors Meme Coins MicroStrategy Ripple SEC Approval Shiba Inu Solana Spot Bitcoin ETFs Technical Analysis Tether whale accumulation Whale Activity