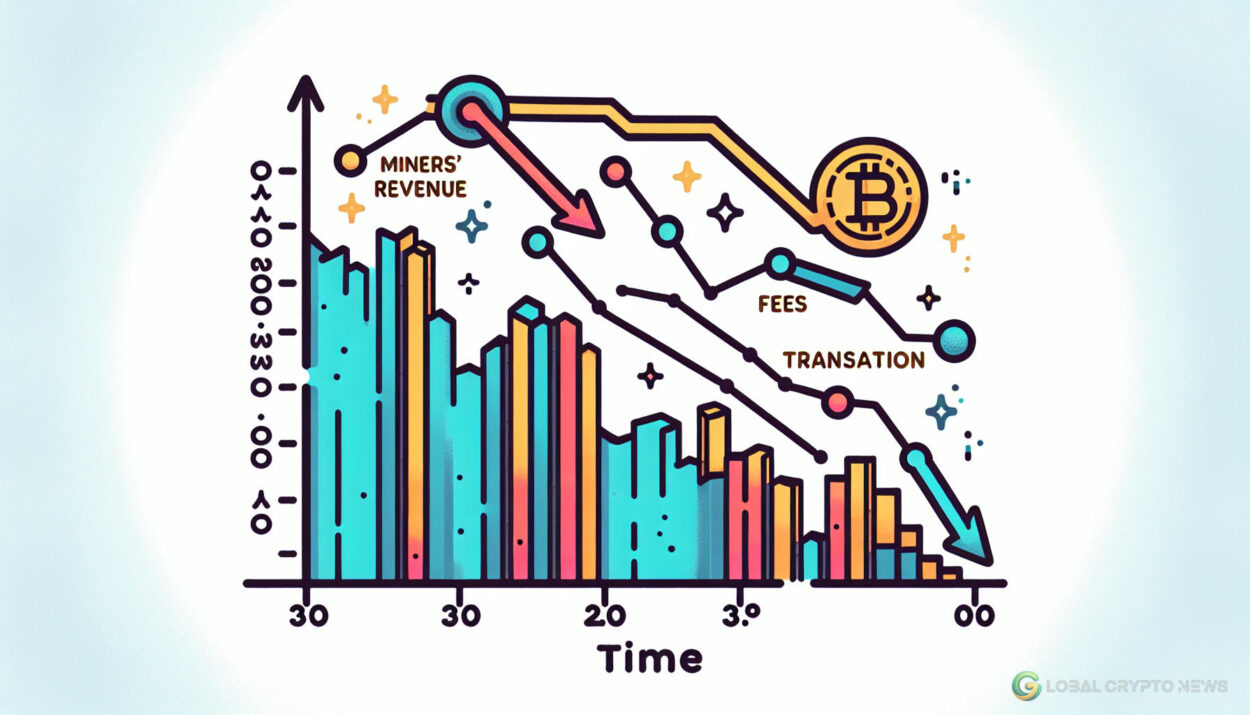

The Bitcoin (BTC) miners’ revenue has been on a decline post the halving event, coinciding with a drop in the average transaction fee on the network. According to YCharts data, the average transaction fee on the Bitcoin network has decreased by 28% in the past 24 hours, currently standing at around $24.99.

The average Bitcoin transaction fee witnessed a significant surge from $19.76 to $128.45 between April 19 and 20. It is worth noting that the transaction fee was as low as $5 a month ago and dropped to $2.8 on April 6.

Following the halving event, the daily Bitcoin miners’ revenue has also been decreasing. YCharts data shows a 5.1% decline in miners’ earnings on April 22, reaching $48.17 million per day. However, despite the recent downturn, the daily BTC miners’ revenue is still up by 87% over the past year, with earnings at $25.7 million on April 23, 2023.

Data from Santiment reveals that the total Bitcoin supply held by miners is currently at 1.86 million BTC. The decrease in BTC production has also led to a reduction in the asset’s price volatility.

Bitcoin is currently trading at $66,175, up by 0.15% in the last 24 hours. The asset’s market cap is hovering around $1.3 trillion, with a daily trading volume of $24.7 billion. The NVT ratio for Bitcoin has decreased from 174 to 88 in the past 24 hours, indicating that the asset is slightly undervalued at its current price point.

In conclusion, the recent decline in Bitcoin miners’ revenue and transaction fees reflects the impact of the halving event on the network. Despite the challenges, Bitcoin continues to maintain its position as a leading cryptocurrency in the market.