After the recent halving event, Bitcoin miners are making strategic changes to adapt to the new landscape. One company, Stronghold Digital Mining, is exploring various options to enhance shareholder value, such as selling the company and its assets.

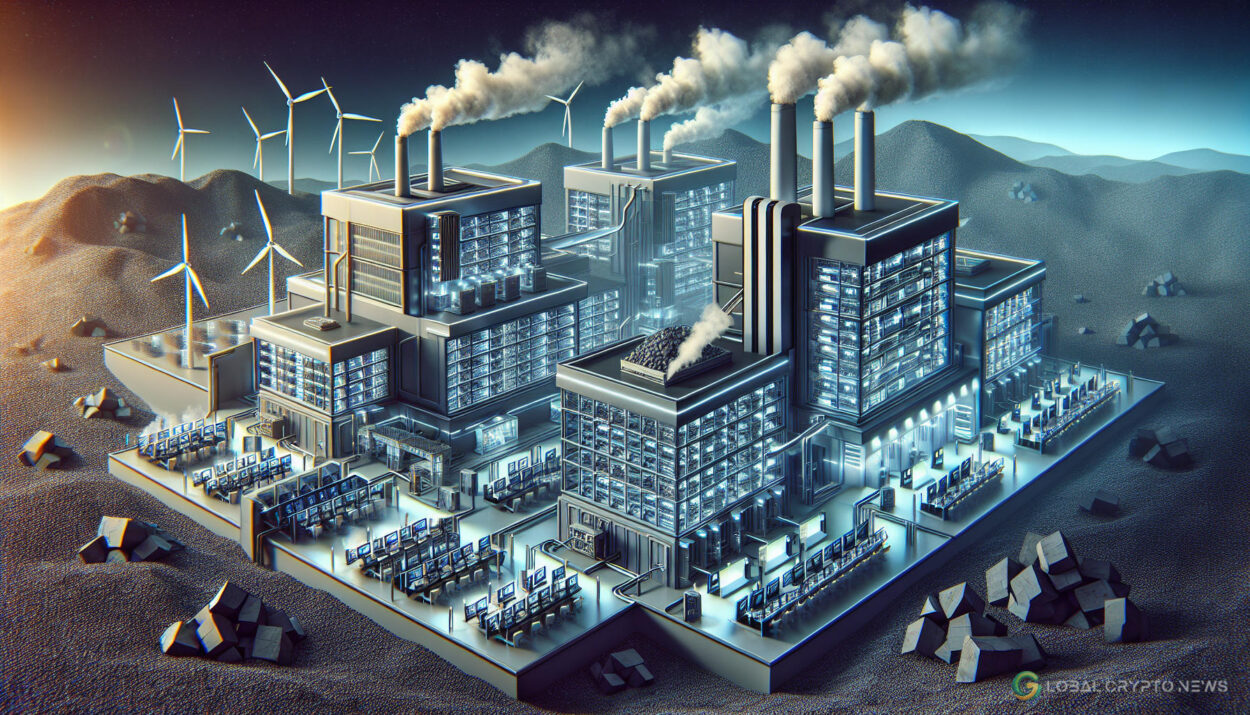

Stronghold Digital Mining utilizes leftover coal to power its cryptocurrency mining facility in Pennsylvania. Despite this unique approach, the company has seen a significant decrease in stock prices compared to its competitors in the market, as per data from Google Finance.

Following the announcement of its strategic review, Stronghold’s stock (SDIG) saw a 7% increase in pre-market trading. The company has enlisted the help of financial advisers Cohen and Company Capital Markets to evaluate potential pathways forward.

“Stronghold’s Board and management team are committed to maximizing value for our shareholders and, to that end, have commenced a comprehensive and thorough review of strategic alternatives.” – Greg Beard, Stronghold CEO and Chairman

While the Bitcoin halving has resulted in reduced mining rewards, leading to lower revenues for miners, there is no immediate sign of capitulation among miners. Some companies, like Marathon Digital, have even expanded their mining capacity this year.

However, the changing landscape of Bitcoin mining post-halving is expected to lead to shifts in the market. Profit margins have been impacted, prompting existing players to consider mergers or acquisitions to strengthen their operations.

“Those who do enter might find success only by focusing on extreme efficiency or alternative models, potentially including Bitcoin mining as part of a diversified mining portfolio to spread risk and chase better returns.” – Edward Mehrez, Arrows Markets co-founder

Despite these changes, experts believe that the price of Bitcoin is unlikely to be significantly affected in the next 18 months following the halving event.