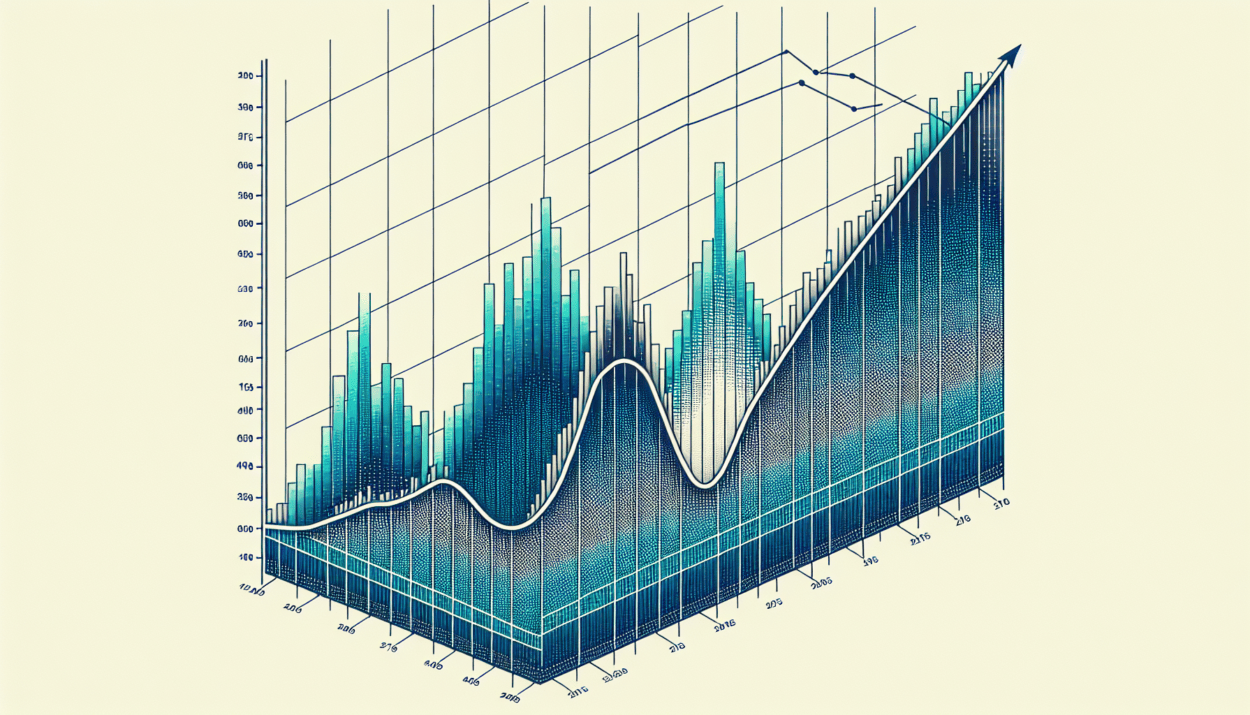

Bitcoin is on the verge of reclaiming its all-time high with a 4% surge, and industry experts are optimistic that the cryptocurrency will see significant growth during this bullish cycle.

Expert Insights

Gracy Chen, managing director at Bitget, believes that Bitcoin could reach $180,000 to $200,000 in the current cycle due to increased interest from institutional investors. The cryptocurrency is currently trading above $67,200, showing a 6% increase in the last 24 hours.

Institutional Inflows

Despite recent outflows from Grayscale’s GBTC ETF, new Bitcoin fund providers have attracted over $7 billion in cumulative inflows. These providers now hold over $20 billion in assets under management and have accumulated 750,000 BTC since January.

Upcoming Supply Shock

Analysts predict a supply shock in the Bitcoin market with the upcoming halving event in April. This event will reduce the mining reward by 50%, maintaining scarcity and potentially driving the price higher.

Positive Sentiment

Industry leaders like Matrixport, Fundstrat’s Thomas Lee, and Anthony Scaramucci anticipate a parabolic rise in Bitcoin’s price driven by increasing demand from spot Bitcoin ETFs and institutional investments.

Bitcoin Address Profits

Recent data shows that 99.75% of Bitcoin addresses are currently in profits, indicating a strong market sentiment. With the price potentially surpassing $67,413, more holders could see profits in their positions.

For more updates on cryptocurrency news and market trends, continue exploring Global Crypto News.