Bitcoin Surges to $95,000, Creating a $9,200 Gap in CME Futures Market

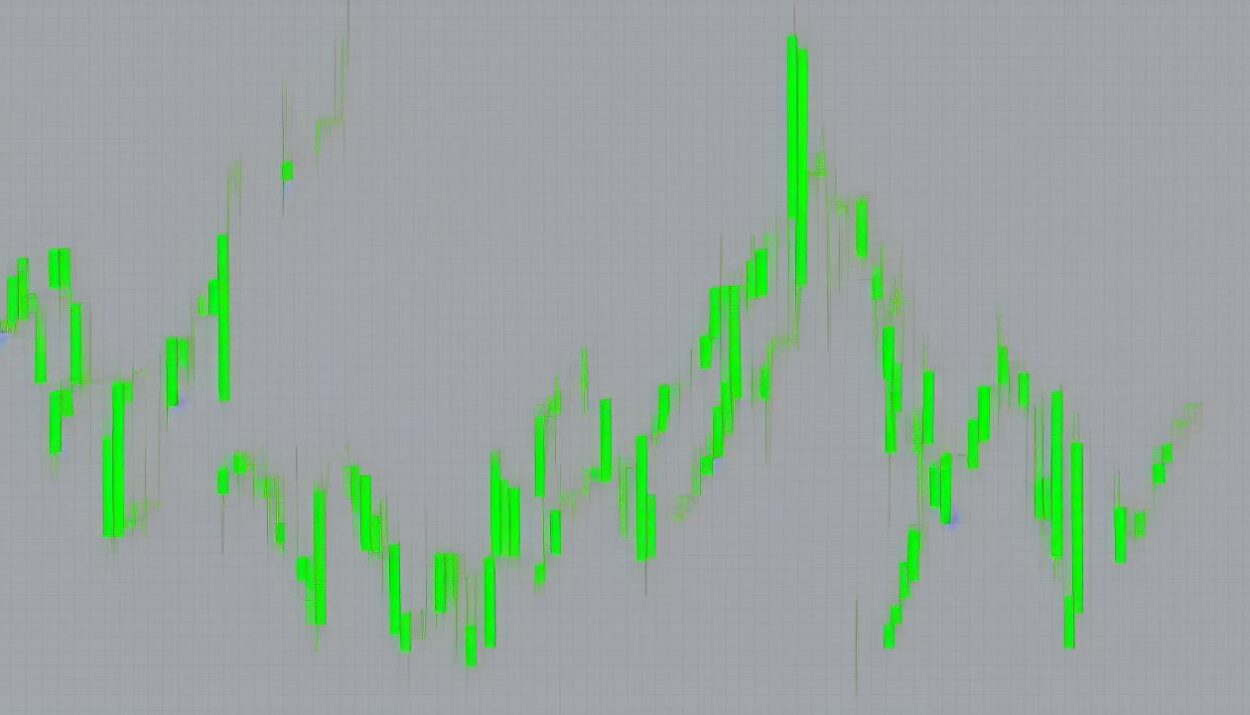

Bitcoin experienced a significant price surge over the weekend, reaching $90,000 and creating another gap in the CME futures market. This 10% increase was largely driven by President Donald Trump’s announcement of a U.S. crypto reserve, which would include prominent cryptocurrencies such as Bitcoin, Ethereum, XRP, Solana, and Cardano.

Market Impact and Gaps in CME Futures

The sudden surge in Bitcoin’s spot price from $84,000 to $90,700 resulted in a gap in March futures, according to CME data. A futures gap is a non-traded zone where no transactions occur between market sessions. By Monday, March 2, Bitcoin had climbed to $95,000, widening the CME futures gap to roughly $9,200. However, by press time, the gap had narrowed to around $6,000.

Understanding Futures Gaps and Market Sentiment

Gaps typically form due to shifts in market sentiment.

They are often filled over time as orders accumulate within these empty zones. A previous gap of $4,300, which appeared in November, was filled during last week’s crypto sell-off.

As the Bitcoin market adjusts, CME futures suggest prices may revisit $84,000 and consolidate within the gap. Bitcoin could also face further downside despite the recent recovery.

Key Market Indicators and Trends

According to TradingView data, BTC/USDT open interest on Binance traded at $72,830, $18,000 below spot and futures prices. This discrepancy highlights the potential for further market volatility.

Some key points to consider for investors and traders:

- Monitor the CME futures gap, as it may indicate potential price movements and market sentiment.

- Keep an eye on open interest and trading volumes to gauge market activity and potential trends.

- Be prepared for potential price fluctuations and adjust your investment strategies accordingly.

Stay up-to-date with the latest news and developments in the world of cryptocurrencies and finance on Global Crypto News.