The recent slowdown in Bitcoin ETF selling isn’t driven by President Donald Trump’s crypto reserve plan but rather shifting market dynamics.

Shifting Market Dynamics

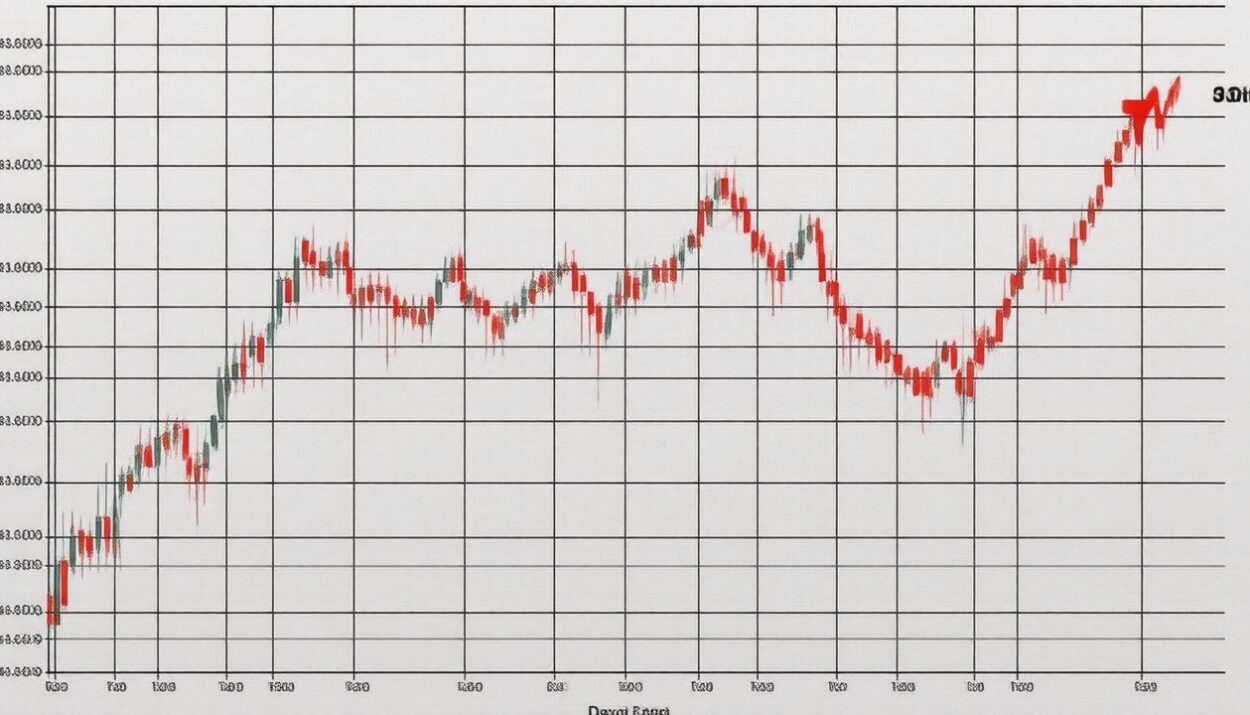

Spot Bitcoin exchange-traded funds saw their largest outflows since launching in January 2024. For now, the selling pressure may be easing, though not necessarily due to President Donald Trump’s statement on a strategic crypto reserve, but seemingly because hedge funds unwound basis trades, analysts suggest.

Analysts believe that hedge funds likely triggered the sell-off by unwinding basis trades, which aligns with the $8 billion drop in CME open interest since the December 2024 FOMC meeting, accounting for over 20% of total ETF inflows. This sentiment is echoed by:

“The selling pressure may have been tied to the February futures expiry, which is now behind us. With this overhang removed, ETF selling by hedge funds could ease, allowing them to reevaluate arbitrage spreads heading into late March.”

Trump’s Crypto Reserve Plan

While it’s unclear how long the pause in selling pressure will last, Bitcoin and altcoins quickly surged after Trump reaffirmed his commitment to making the U.S. “the Crypto Capital of the World.” His new executive order directs officials to establish a national crypto reserve, including:

- Bitcoin

- Ethereum

- XRP

- Solana

- Cardano

As Bitcoin rose 8%, breaking $93,000, Ethereum followed with an 11% jump. Yet, these gains were modest compared to Cardano’s 66% surge, while Solana and XRP gained 20% and 28%, respectively.

Crypto Market Outlook

Despite the rally, the Crypto Fear & Greed Index remains in “Fear” territory at 33. This suggests that investors remain cautious, and the market is still vulnerable to fluctuations.

Stay up-to-date with the latest news and trends in the world of cryptocurrency and finance on Global Crypto News.