Meme Coins Take a Hit as Bitcoin Remains Steady

Meme coins have experienced a sharp decline in the past 24 hours, with Dogwifhat (WIF), Ai16z (ai16z), and Bonk (BONK) leading the losses among the sector’s largest tokens. However, Bitcoin (BTC) has maintained its stability, with a minimal decline of 0.63% and 0.93% on the daily and weekly timeframes, respectively.

This divergence highlights a common trend in the cryptocurrency market: Speculative assets like meme coins rely heavily on momentum and hype. When Bitcoin is stable, trading volume and liquidity in meme coins often dry up, leading to price declines.

Ai16z: A Bearish Trend

The daily chart for Ai16z indicates a prevailing bearish trend, with the price currently standing at $0.32, below the 7-day simple moving average (SMA) at $0.34. The immediate area of interest is the support level at around $0.30, which has been tested multiple times.

If this support breaks, the next critical zone lies between $0.27 and $0.28, an area where the price previously consolidated before attempting a short-lived upward move. The $0.40 level stands as the next key resistance, with sellers remaining active in this area.

A more significant bullish shift would require a breakout above the $0.45 – $0.50 range, an area that marked the beginning of the current downtrend.

Dogwifhat: A Prevailing Downtrend

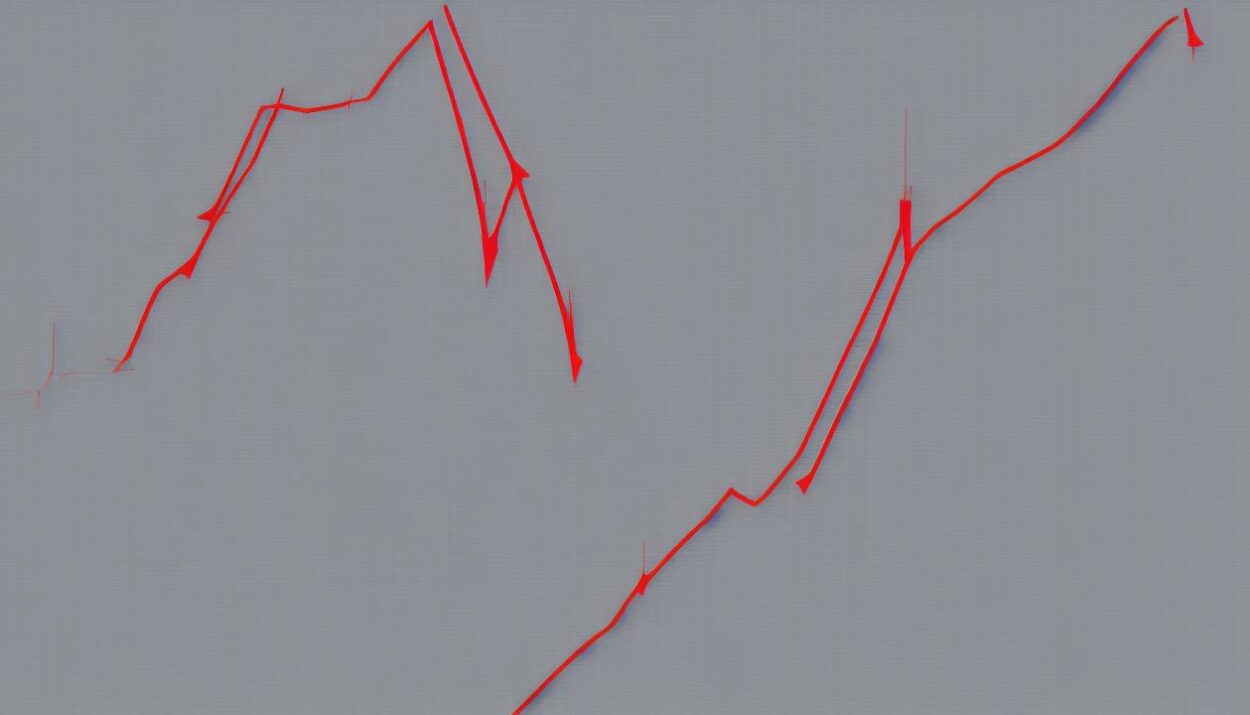

The daily price chart for Dogwifhat shows a prevailing downtrend, with the 7-day SMA sloping downward. As of now, WIF is trading at $0.60, which is below the 7-day SMA of $0.64.

If the price can move past this level, the next resistance lies in the $0.70 – $0.75 range. Support is holding around $0.60, a level that has been tested multiple times. If this level fails, a further decline toward $0.55 is possible.

For a potential reversal, WIF would need to break and sustain above the 7-day SMA while reclaiming the $0.70 – $0.75 zone. Until that happens, the bears remain in control, and the risk of further declines persists.

Bonk: Sellers in Control

BONK is trading at $0.00001451, which is below the 7-day SMA of $0.00001557. Despite brief periods of sideways consolidation, especially in mid-February, the price has struggled to break above the 7-day SMA, indicating that sellers remain in control.

In terms of structure levels, the most immediate one is around $0.00001400, a level that has been tested multiple times. If the price fails to hold above this support, further downside movement could push it toward the $0.00001250 – $0.00001300 range, where historical price action suggests some stability.

The $0.00001750 – $0.00001800 region represents a significant resistance zone where BONK previously faced strong selling pressure. A breakout above this level would indicate a potential trend reversal and shift the sentiment toward a more neutral or bullish outlook.

The Broader Crypto Market Downturn

The sharp decline in meme coin prices is largely a reflection of the broader crypto market downturn, with almost all altcoins bleeding on the daily time frame. However, it’s also true that the meme coin sector has been hit particularly hard by recent events.

“Sentiment now is probably as low, or even lower than during the FTX collapse,”

As analysts have already begun commenting on the end of the meme coin era, it’s essential to consider the potential risks and opportunities in the market.

Some key tips for navigating the current crypto market:

- Keep an eye on Bitcoin’s stability, as it can impact the broader crypto market.

- Be cautious of speculative assets like meme coins, which rely heavily on momentum and hype.

- Monitor structure levels and support zones to anticipate potential price movements.

Stay up to date with the latest news and trends in the crypto market by following Global Crypto News.