Maker (MKR) Price Surges 44% Amidst Whales Cashing Out and On-Chain Indicators Supporting Further Gains

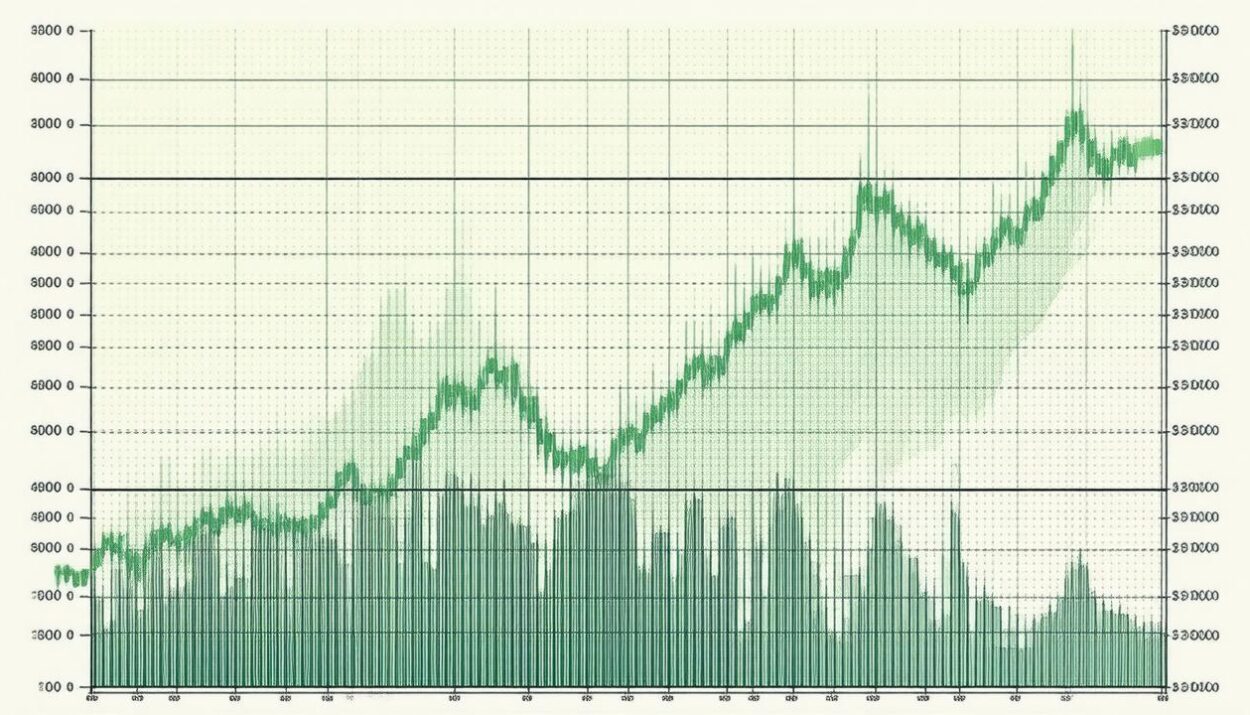

The Maker (MKR) price has rallied over 44% in the past week, with the DeFi token holding steady despite large wallet investors and whales taking profits in the ongoing price surge. On-chain and technical indicators support further gains in Maker.

Maker Derivatives and On-Chain Analysis

Derivatives data from crypto intelligence platforms shows a large positive spike in Open Interest in MKR, representing a massive increase in the total value of open contracts in MKR across derivatives exchanges. The total value of assets locked in MKR has surged to $5.675 billion, coinciding with the rising price, relevance, and demand for tokens among traders.

Santiment data shows several negative spikes in Network realized profit/loss metric in the MKR chart since mid-January 2025, indicating that several traders and MKR holders are shedding their holdings and realizing losses. Consistent realization of losses is typically considered a sign of capitulation and is consistent with an eventual recovery in the token’s price.

Additionally, MKR’s daily active addresses recorded a nearly three-month peak this week, signaling the rise in interest from traders. The In/Out of money around price indicator shows that 30% of wallet addresses holding MKR are currently sitting on unrealized losses, while 65.55% of MKR token holders have unrealized gains in their portfolio.

Maker (MKR) Weekly Price Forecast

Maker broke out of its downward trend on February 12 and has rallied, extending gains nearly every day this week. The token is close to resistance at $1,632 and $2,050, two key levels in MKR’s upward trend between October 26 and December 4.

Two key technical indicators, the Moving average convergence divergence indicator and relative strength index, flash bullish signs on the daily timeframe. A rally to test resistance at $1,632 marks a nearly 15% rally in MKR price.

Whales Cashing Out Amidst Price Surge

Despite whales cashing out their MKR holdings, the token price is holding steady. A wallet address identified as inveteratus.eth on the blockchain sold 1,230 MKR worth 1.78 million USDC and secured a 30% profit of $418,000 within less than a month.

DAO Drama Unfolds Amidst Token Rally

The drama surrounding Sky Protocol (Maker DAO) is being identified as a “potential governance attack,” according to the community on X. The community debates a proposal that asks for relaxing restrictions on borrowing against MKR, the governance token of the Sky Protocol chain.

Token Burn Supports Price Gains

A $17 million token burn, identified on the blockchain, has reduced the selling pressure and supported price gains. The burn removes tokens from the supply permanently, reducing the supply and increasing demand.

At the time of writing, MKR trades at $1,432. Remember that this article does not represent investment advice, and the content and materials featured on this page are for educational purposes only.

Stay up-to-date with the latest news on Global Crypto News.