Ripple Price Surge: What’s Behind XRP’s 50% January Jump?

Ripple’s XRP token had a remarkable month in January, outperforming top cryptocurrencies like Bitcoin and Ethereum. XRP rose by over 50%, while Bitcoin jumped by 12% and Ethereum fell by 6%. This surge also surpassed other large-cap coins like Polkadot, Solana, and Binance Coin.

Driving Factors Behind XRP’s Price Surge

Several catalysts contributed to XRP’s surge in January. One key factor was the performance of the Ripple USD stablecoin. It flipped top stablecoins like PayPal USD and Ethena USDe in terms of volume, with a daily volume of $62 million on January 30.

Another significant factor was the resignation of Gary Gensler, which ushered in a new regulatory environment. The SEC, under Mark Uyeda and Paul Atkins, is expected to be more friendly to the crypto industry. This shift may benefit Ripple, as its legal issues with the agency may be resolved this year.

Additionally, the odds of the SEC approving a spot XRP ETF rose on Polymarket. JPMorgan analysts predict that such a fund would attract over $8 billion in inflows this year, significantly higher than Ethereum ETFs, which have had less than $3 billion in inflows since their launch.

Ripple Labs’ New York License and Ecosystem Growth

Ripple Labs’ receipt of a money transmitter license in New York also contributed to the XRP price surge. This license enables the company to work with other large firms in the state and offer more services.

The XRP Ledger is also growing, with ecosystem tokens like Sologenic, Crypto Trading Fund, XRP Army, and PHNIX gaining market share. Sologenic has a market cap of $174 million, while the XRPL total value locked hit a $80 million total value locked.

XRP Price Technical Analysis

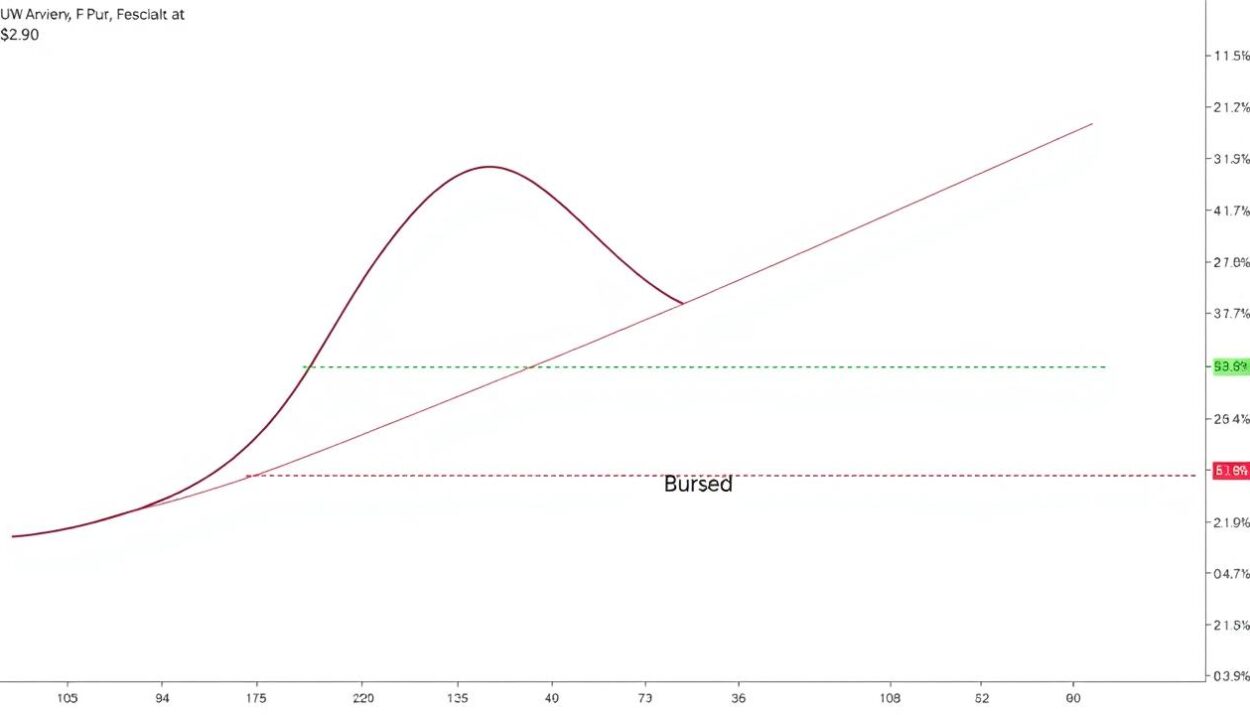

Technical analysis suggests that the XRP price will experience a strong bullish breakout in February. The daily chart shows a bullish pennant pattern with a long vertical line and a symmetrical triangle pattern. A bullish breakout above its upper side at $2.90 on January 15 indicates a potential target at the psychological level of $5, about 65% above the current level.

Tips for investors:

- Monitor the XRP price for a potential breakout in February.

- Keep an eye on the SEC’s regulatory environment and its potential impact on Ripple.

- Consider the growing XRP Ledger ecosystem and its potential for growth.

For more news on cryptocurrencies and investing, visit Global Crypto News.