Ethereum Price Drops to Critical Support Level Amid Market Pullback

The Ethereum price has declined to a critical support level, marking a 10% drop from its peak earlier in the week. Following the Federal Reserve’s hawkish interest rate announcement, the cryptocurrency market experienced a sharp pullback, with Ethereum slipping to $3,540.

Cryptocurrency Market Sell-Off

The retreat in Ethereum’s price coincided with the sell-off of other major coins, including Bitcoin and Solana. Despite this, Ethereum’s fundamentals remain strong, with steady inflows into Ethereum Exchange-Traded Funds (ETFs) now totaling over $2.46 billion.

Strong Fundamentals and Growing Interest

Ethereum ETFs have seen 18 consecutive days of inflows, reflecting growing interest from investors. The absence of staking options has likely deterred some institutional investors from fully embracing these funds. However, the anticipation of the SEC allowing staking within these funds may soon change this.

Funds by companies like Grayscale, Blackrock, Fidelity, Bitwise, and VanEck are the biggest holders of Ethereum. The growing interest in Ethereum ETFs is a positive sign for the cryptocurrency’s long-term prospects.

Rising Staked ETH Coins

The number of staked ETH coins has continued to rise, with over 54.7 million ETH tokens now staked. This trend is supported by a growing base of more than 206,000 unique stakers, underscoring long-term bullish sentiment among investors.

Decentralized Finance Ecosystem

Ethereum remains the biggest player in the blockchain industry, with the total value locked in its Decentralized Finance (DeFi) ecosystem rising to over $73.7 billion. This is significantly higher than most other chains, including Solana, Base, and Arbitrum, combined.

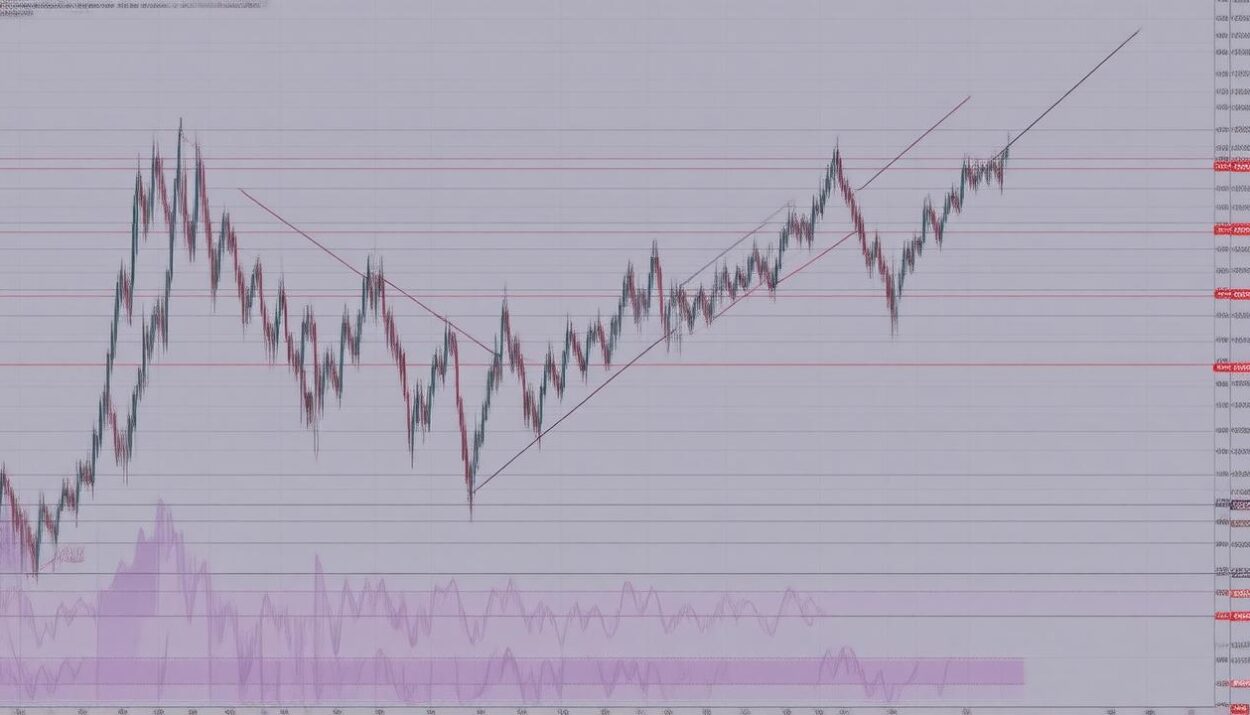

Ethereum Price Analysis

The daily ETH chart reveals a sharp reversal after the price reached $4,090, a critical resistance level. This level corresponds to the December 6 and March 11 highs, as well as the extreme overshoot level on the Murrey Math Lines.

Ethereum has formed a bearish double-top pattern at this resistance, with its neckline positioned at $3,526. This pattern signals potential further declines, with ETH possibly testing the major support and resistance pivot point at $3,125. More gains will be confirmed if Ethereum rises above the resistance level at $4,090.

Tips for Ethereum Investors

For Ethereum investors, it’s essential to keep an eye on the following:

- Watch for further declines, potentially testing the major support and resistance pivot point at $3,125.

- Monitor the neckline of the bearish double-top pattern at $3,526.

- Keep an eye on the total value locked in Ethereum’s DeFi ecosystem.

- Stay informed about the SEC’s stance on staking options within Ethereum ETFs.

Stay ahead of the curve with the latest news and updates on Ethereum and the cryptocurrency market. Visit Global Crypto News for more insights and analysis.