Ethereum, the second-largest cryptocurrency, has struggled to keep pace with Bitcoin this year due to slow growth in its exchange-traded funds and competition from other blockchains.

Ethereum’s Performance in 2024

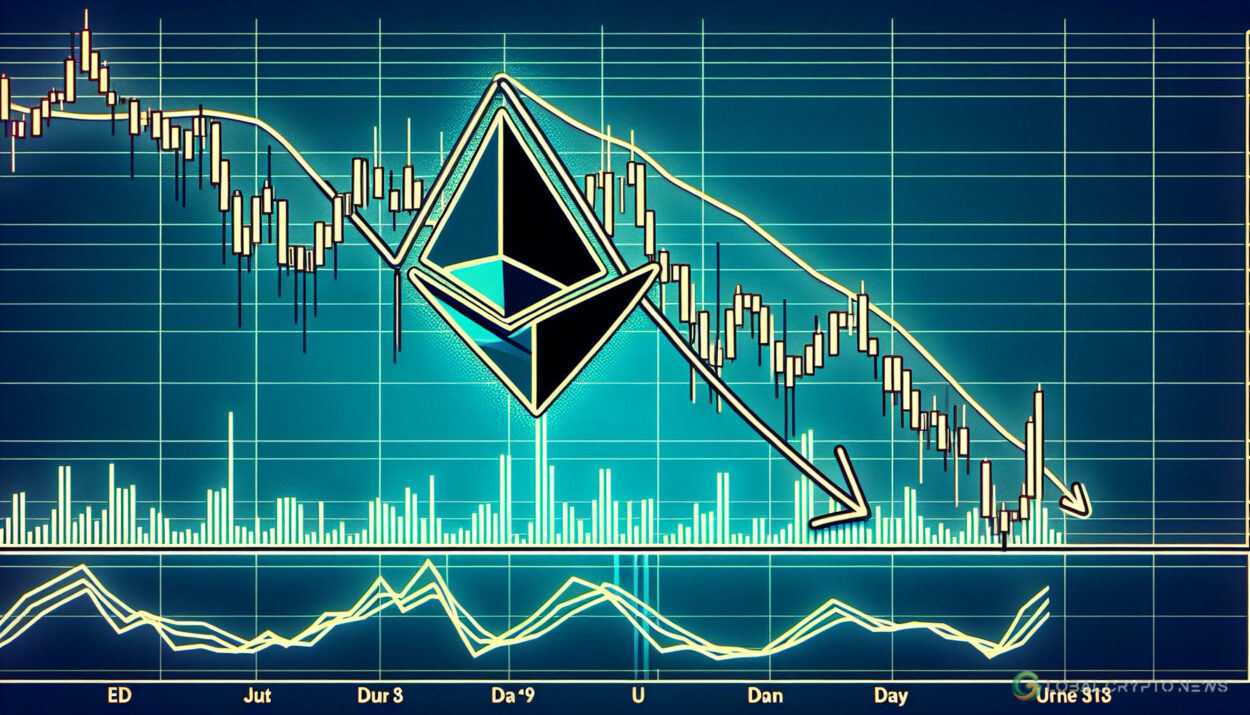

Ethereum has seen a modest rally of less than 20% in 2024, while Bitcoin has surged by over 50%. Technical analysis indicates potential further weakness for Ether in the coming months. A double-top chart pattern around $4,000 has formed on the weekly chart, followed by a drop below the $2,824 neckline in July, confirming a bearish breakout.

Technical Indicators

Ethereum has also formed a death cross pattern as the 200-day and 50-day Hull Moving Averages crossed bearishly. The HMA reduces lag by using weighted moving averages to smooth out price data. The last instance of a death cross on Ethereum’s weekly chart was in March 2022, leading to a drop of over 70%.

Additionally, a bearish pennant chart pattern has emerged, characterized by a long vertical line followed by a symmetrical triangle. This consolidation is occurring at the 50% Fibonacci Retracement level, increasing the likelihood of a bearish breakout. The next key level to watch is $2,111, the lowest point on August 5.

Fundamental Challenges

Beyond technicals, Ethereum faces significant fundamental challenges. Notably, Ether ETFs have experienced cumulative outflows of over $530 million, primarily due to the Grayscale Ethereum Fund. In contrast, Bitcoin ETFs have attracted over $20 billion in inflows, indicating stronger demand from institutional investors.

Ethereum is also losing ground in areas it once dominated, such as DeFi and NFTs. According to recent data, Solana has surpassed Ethereum in terms of DEX volume over the past week, handling $10.87 billion compared to Ethereum’s $9.69 billion. Solana’s performance is bolstered by the popularity of meme coins like Dogwifhat, Bonk, and Popcat, which have collectively gained over $10 billion in market cap.

High-Profile Sales

Additionally, some high-profile Ethereum holders, including Vitalik Buterin and the Ethereum Foundation, have recently sold thousands of coins. For instance, a wallet related to #DiscusFish deposited 2,044 ETH ($5.45M) and 155,720 LINK ($1.85M) to Binance, contributing to a total of 12,347 ETH ($30.4M) deposited since October 2.

A combination of weak fundamentals and technical indicators could push Ether lower in the coming weeks.

Stay updated on the latest cryptocurrency news and trends to make informed investment decisions.

#MarketTrends #BitcoinPrice