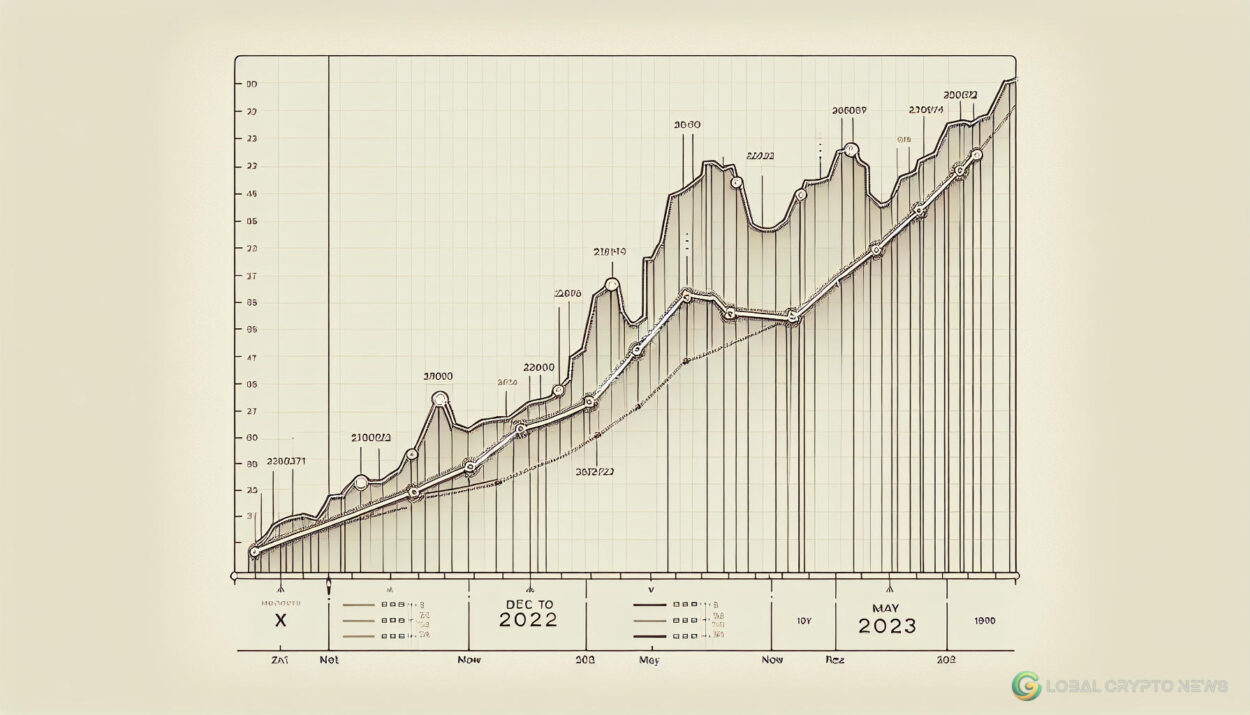

Bitcoin mining difficulty has reached its lowest level since December 2022, dropping by 5.63% to 83.15 T on May 9. This decrease is comparable to the 2022 bear market phase, which saw a series of bankruptcies in the industry. The average hashrate over the past two weeks was 595 EH/s, down from 630 EH/s, indicating miners may have shut down equipment that became unprofitable after the recent Bitcoin halving.

The next adjustment in difficulty is set for May 23, with a predicted drawdown of 0.19%. Following the halving of the block reward from 6.25 BTC to 3.125 BTC on April 20, mining difficulty spiked due to high network fees. However, miners’ income remained relatively stable despite the reward reduction.

By early May, daily revenue for Bitcoin miners had fallen to levels last seen in October 2023. Data from Blockchain.com shows total miner income dropped to $26.38 million on May 3. Despite this, Ki Young Ju, CEO of CryptoQuant, believes miners have not yet reached a point of capitulation. He suggests that Bitcoin’s price should reach $80,000 to maintain profitability post-halving.

It seems that miners are now faced with two options: capitulate or wait for a rise in Bitcoin price. However, as of now, there are no clear signs of capitulation within the industry.